Table of Contents

Disclaimer: Activities in the Egypt market are conducted through Thndr Securities Brokerage, which is a member firm of the Egyptian Stock Exchange and is authorized and regulated by the Financial Regulatory Authority . Registered in Egypt (no. 804)

If you are a qualified investor who is interested in participating in the private offering of the United Bank IPO, then here’s everything you need to know.

Who is a qualified investor?

To participate in the private offering, you must meet the following criteria:

- Experience: At least 10 years of experience in investing, wealth management, or related fields such as banking or financial services.

- Assets: Own liquid assets, securities, or financial instruments worth at least EGP 5,000,000.

Key considerations before knowing the details

- This private offering is not covered by a stabilization fund. Accordingly, If the stock price drops, you won’t have the option to return your shares within 30 days or recover your investment. This differs from the public offering which has a stabilization fund that covers 100% of the offering.

- While private offering investors typically face less oversubscription than in the public offering, allocation is still not guaranteed and is determined by the company’s shareholders.

- If you participate in the private offering, you cannot invest in the public offering through Thndr or any other brokerage.

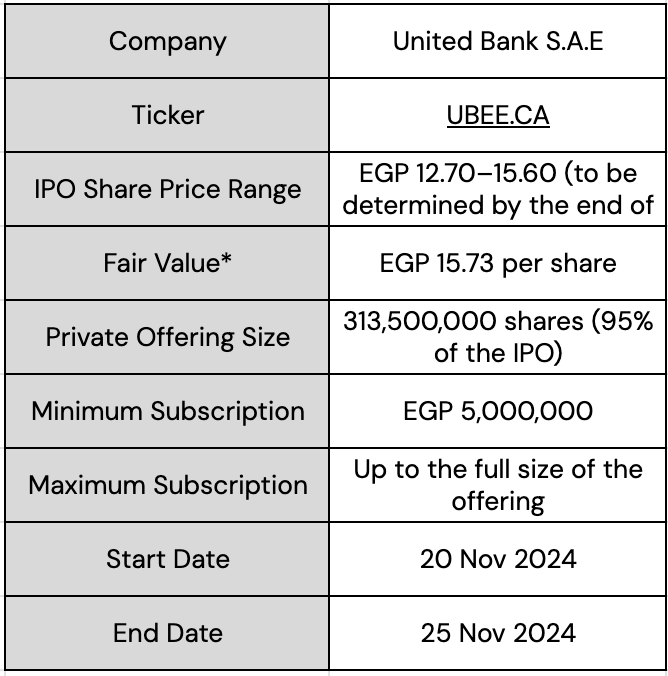

Private offering details

*The share price determined by an independent financial expert and included in the IPO prospectus as a guide for investors

How to participate in the private offering

Step 1: Confirm your qualification

If you meet the criteria of a qualified investor, fill in this form by 21 November 2024.

This form will be reviewed by the Thndr team and will help determine your eligibility.

Step 2: Deposit funds

Ensure you have deposited the full order amount into your Thndr app wallet before placing your order and before 25 November 2024, 12 PM.

The minimum order value is EGP 5,000,000, and the option to subscribe with 4x your wallet balance is not applicable.

Step 3: Fill in the order form

Fill in the order form before 25 November 2024, 12 PM with the requested details:

- Number of shares you wish to purchase along your bid price

- Your selected bid prices must fall within the IPO price range

Step 4: Confirming order placement

Thndr will confirm that your order has been placed and will share updates once executed with the allocated quantity.

Step 5: Allocation and final pricing

Thndr will confirm your allocation (if successful) and the final IPO price will be announced on the 27 of November 2024. Please note that allocation will not be based on pro rata and its discretionary by the IPOing company.

Step 6: Settlement and refund

The subscription amount will be deducted once your order is fulfilled. Any remaining balance will be refunded to your Thndr wallet by 27 of November 2024.

Additional notes:

- Your allocated quantity will appear on your portfolio through the app after the public offering of the IPO is concluded, and the process will remain offline.

- The total order value will appear blocked in your Thndr wallet but won’t display as a pending order on the app.

- Standard fees will apply (details here).

- A dedicated Thndr support representative will be assigned to you and guide you through the process.