Table of Contents

Who is Gourmet Egypt?

Gourmet Egypt.Com Foods is a leading premium grocery retailer, established in 2006. The company operates 19+ stores across Cairo and Alexandria, supported by a strong e-commerce app and website.

What is happening?

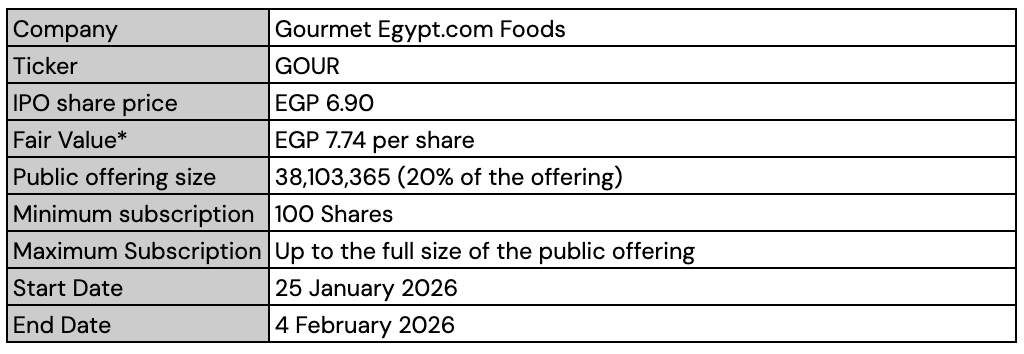

Gourmet Egypt is offering part of its shares through an Initial Public Offering (IPO) on the Egyptian Exchange (EGX).

This IPO is divided into:

- Public Offering: 20% of the IPO.

- Private Offering: 80% of the IPO.

Public Offering Details

The public offering is supported by a stabilization fund covering 100% of the offering during the first 30 days of trading.

What is a stabilization fund?

During the first 30 days of trading, if you are not satisfied with the stock’s performance you can use the stabilization fund to get your investment value back.

This means if the stock price goes down below the IPO price during the first 30 days of trading, you can return your shares at the purchase price.

Please note:

- When subscribing you can subscribe with up to 4 times the amount in your wallet.

- 25% of your order value will be held until the order is executed

How do I participate?

On the IPO start date:

- Open the thndr app

- Go to the explore tab

- Search “GOUR” or “Gourmet” and you will be able to access the IPO page

- You will be able to place your order

- Your order will remain pending until the IPO end date

What is Oversubscription?

If the demand for shares exceeds supply, the IPO becomes oversubscribed. This means each investor will receive only a portion of their requested shares.

Example

Let’s say you subscribe for 10,000 shares, and the IPO is oversubscribed 10X:

- Shares in your order: 10,000

- Oversubscription: 10X

- Your allocation: 10,000 ÷ 10 = 1,000 shares

Actual Allocation

The Gourmet IPO was 55.78 times oversubscribed, which means each investor will receive 1/55.78 of the shares they requested.

Example:

If you subscribed for 30,000 shares and the allocation is 55.78x:

How allocation is calculated:

Number of shares in your order = 30,000 shares

Number of shares allocated = Number of shares ÷ Oversubscription

30,000 ÷ 55.78 ≈ 538 shares

This means you’ll be allocated 538 shares out of your original order of 30,000 shares.

First Day of Trading

The Egyptian Exchange announced that Tuesday, 10 February 2026 will be the first day of trading for Gourmet Egypt.

During the first trading session:

- The opening price will be EGP 6.90

- A 40% price limit will apply on the first trading day

- T+0 / T+1 trading will be enabled

- You’ll be able to place limit buy and sell orders and market sell orders

- Market buy orders will be temporarily disabled to protect you from buying the stock at an unpredictable price during the opening session

Once a closing price is set on the first trading day, the stock will then follow standard 20% price limits.