Table of Contents

Activities in the UAE Market are conducted through Thndr Financial Ltd (“Thndr”) is registered under the laws of the Abu Dhabi Global Market (“ADGM”) with the Registered Number 13534.

What is an ETF?

An ETF (Exchange Traded Fund) is a “basket” or group of securities such as stocks, bonds, or real estate bundled into a single tradable ticker.

Why invest in an ETF?

Instead of buying many individual stocks or bonds, an ETF lets you invest in hundreds or even thousands of companies at once.

This makes it easier to diversify your portfolio and means you can buy and sell ETFs any time during market hours.

ETFs are traded on stock exchanges just like regular stocks, and their prices change throughout the trading day. This gives investors flexibility and real-time access to market movements.

What are the types of ETFs?

ETFs can be grouped by:

- What they invest in

- How they are managed

1. What They Invest In

Some ETFs invest in a mix of companies or assets, while others focus on a specific theme or sector:

- Broad Market ETFs: Track large indexes like the S&P 500 or Nasdaq 100.

- Sector ETFs: Focus on specific industries such as Technology, Energy, or Real Estate.

- Commodity ETFs: Invest in gold, oil, or metals.

- Bond ETFs: Focus on fixed income instruments like U.S. Treasury or corporate bonds.

- Thematic ETFs: Follow themes like clean energy, AI, or cybersecurity.

2. How They are Managed

- Index-Tracking (Passive) ETFs: These follow a specific market index and aim to match its performance. Example: An S&P 500 ETF automatically includes companies that make up the index.

- Actively Managed ETFs: These are run by fund managers who choose investments based on research, trends, or opportunities. They aim to outperform the market rather than just mirror it.

How to invest in ETFs?

- Open the Thndr app.

- Search for the ETF you want to invest in

- Tap on the ETF you chose

- Tap on “Buy.”

- Enter the amount you want to invest.

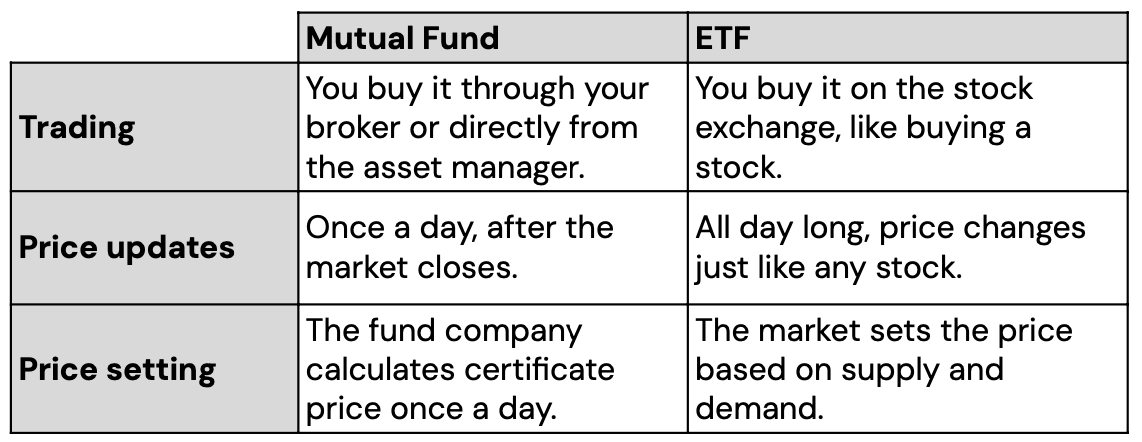

What is the difference between an ETF and a mutual fund?

An ETF combines the diversification of a portfolio with the flexibility of trading like a stock on an exchange throughout the day.

Mutual funds are typically bought and sold only once a day through the fund manager, and their pricing is set at the end of the trading day.

What are the benefits and risks of ETFs?

Benefits:

- Diversification: Exposure to many companies in one investment.

- Flexibility: You can buy or sell any time during market hours.

- Transparency: You can usually see what the ETF holds every day.

Risks:

- Market risk: ETF prices rise and fall with the market.

- Tracking differences: The ETF’s price may move slightly away from the actual value of its assets in volatile times.

- Liquidity: Some niche or small ETFs may trade less actively, affecting how easily you can buy or sell.

Each ETF has its own risk level and investment strategy. Before investing, review the fund’s details and choose what aligns with your financial goals and risk tolerance.