Table of Contents

Who is Tawasoa for Factoring?

Tawasoa for Factoring is a non-banking financial institution licensed by the Financial Regulatory Authority (FRA). Founded in 2020, the company provides factoring and working capital financing solutions in Egypt.

Tawasoa is now becoming a publicly traded company on the Egyptian Exchange (EGX) SMEs market through this IPO.

What is happening?

Tawasoa is going public on The EGX’s SMEs market and offering 18,750,000 shares through a private offering and a public offering at an offer price of EGP 1.73 per share. This IPO will allow new investors to own shares in the company.

You can subscribe to this IPO directly through the Thndr app.

This IPO is divided into:

- Public Offering: Up to 3.75 million shares

- Private Offering: Up to 15 million shares

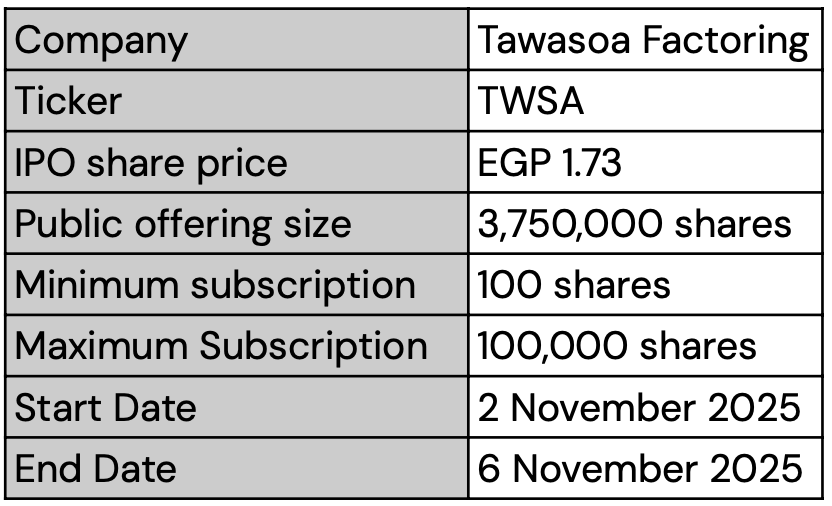

Public Offering Details

The public offering is supported by a stabilization fund covering 100% of the offering for the first 30 days of trading.

What is a Stabilization Fund?

It’s a safety net for investors. If the stock price falls below the IPO price during the first 30 days of trading, you can return your shares and recover your full investment at the offer price.

How do I participate in the Public offering?

On the IPO start date:

- Open the Thndr app

- Go to the Explore tab

- Search for “TWSA” or “Tawasoa”

- Access the IPO page and place your order

- Your order will remain pending until the IPO closes

Please note:

- You can subscribe with up to 4× the amount available in your Thndr wallet.

- 25% of your order value will be held until execution.

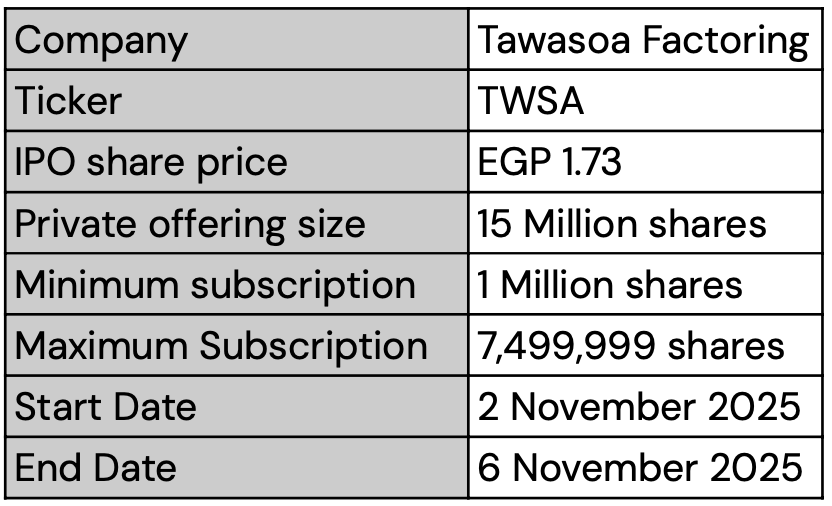

Private offering: For Thndr Qualified Investors

Who is a qualified investor?

To participate in the private offering, you must meet the following eligibility criteria:

- Experience: At least 10 years of experience in investing, wealth management, or related fields such as banking or financial services.

- Assets: Own liquid assets, securities, or financial instruments worth at least EGP 5,000,000.

Key considerations

- The private offering is not covered by a stabilization fund.

- While private offering investors typically face less oversubscription than in the public offering, allocation is still not guaranteed and is determined by the company’s shareholders and at their discretion.

- If you participate in the private offering, you cannot invest in the public offering through Thndr or any other brokerage.

Private Offering Details

How to participate in the private offering

Step 1: Review the Eligibility Criteria

Make sure you meet the eligibility criteria and fill this form before 3:00PM on 5 November 2025.

Step 2: Fund your wallet

Ensure that the full subscription amount is available in your Thndr wallet before the submission deadline. Orders will not be processed if the full amount is not available in your Thndr wallet.

Step 3: Submit your order

- You can submit your order through this form until 3:00PM on 5 November 2025.

- Make sure to use the same email address registered on your Thndr account.

- The offer price is EGP 1.73 per share.

- The minimum subscription is 1,000,000 shares (EGP 1,730,000).

- Once submitted, 100% of your order value will be blocked in your Thndr wallet.

- Only your latest submission will be processed.

- The total order value will appear as blocked in your Thndr wallet but won’t display as a pending order on the app.

Please note: Submitting your order does not guarantee allocation. Allocation will depend on the company’s review and discretion.

Step 4: Confirmation & Allocation

- Thndr will review your order and confirm once it has been submitted successfully.

- Allocation results and the final confirmation will be announced after the vetting process.

- Allocations are not based on a pro-rata system and are subject to company discretion.

- Standard fees will apply (details here)

Step 5: Settlement & Refund

Once your order is approved and allocated:

- The blocked amount will be deducted from your wallet.

- Any unallocated funds will be refunded automatically to your wallet.

- Allocated shares will appear in your Thndr portfolio after the offering concludes.