Compound interest is one of the most powerful concepts in finance. Albert Einstein even called it the “eighth wonder of the world”. Let’s see how compound interest works, and how you can use it to your advantage.

What is compound interest?

Compound interest is when interest gets added to the initial amount invested or borrowed, and then the interest rate applies to the new (larger) amount. It’s basically interest on interest, which over time leads to exponential growth. Compounding can work to your advantage as your investments grow over time — or against you if you’re paying off debt.

How does compound interest work?

There are two types of interest, simple and compound. Simple interest is… well, simple. For every period within the duration of the investment, the investor receives a percentage of the original amount. We can calculate simple interest using the following formula:

Simple interest = principal x rate x time

Consider this example: You invest $12,000 with an annual interest rate of 8% for two years. You will be paid the principal, $12,000, plus $12,000 x 0.08 x 2, which is $1,920, in interest. You will now have a total of $13,920.

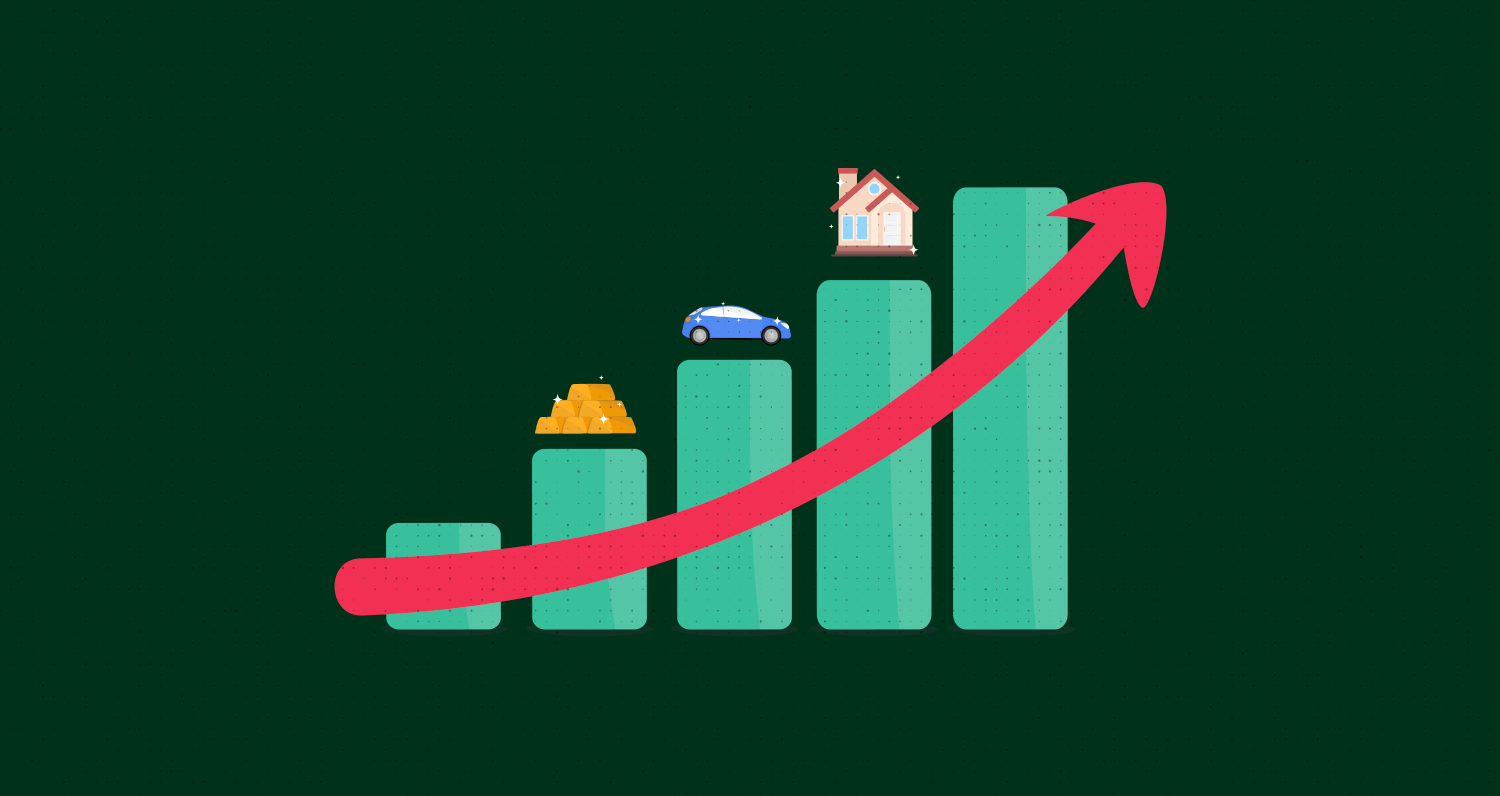

In reality, compound interest is used more commonly. Instead of receiving interest on the principal, you receive interest on both the principal and on any existing interest. You can visualize the impact of compound interest by imagining a snowball getting bigger as it rolls down a hill. The larger the snowball gets, the more snow it picks up, making it grow at a faster and faster rate. This is similar to the process of compounding. The larger an investment gets, the more interest it picks up, meaning it also grows at a faster and faster rate.

Here is the formula for compound interest:

A = P(1 + r/n)nt

A is the total amount owed, including both the principal and the interest.

P is the principal, or the original deposited amount.

r is the annual nominal interest rate.

n is the frequency of compounding per unit of time.

t is time, or the duration of the loan.

Now for an example: let’s say you invest $1,000 in a money market account paying 10% interest. After the first year, you would earn $100 in interest – that is, 10% of your initial $1,000. After the second year, you would earn $110 in interest, or 10% of your combined $1,100. After 30 years, your investment would have grown to $17,449. If the same investment had paid simple interest, you would only have $4,000 by that time.

As you can see, your investment grows much faster under compound interest compared to simple interest. While an investment earning simple interest grows at a constant rate, an investment earning compound interest will grow at a faster and faster rate over time.

Why does compound interest matter?

It’s important to understand the ways that compound interest can either help you as an investor, or hurt you as a borrower.

As an investor, you benefit from compounding because it makes your investments grow faster. This is especially true the longer you remain invested, so it pays to begin investing early. The earlier you begin investing, the more compounding works to your advantage.

On the other hand, you could see your debt snowball thanks to compound interest. The higher the nominal interest rate, the faster you will build up debt. You can avoid the pitfalls of compound interest by paying down debt quickly, rather than waiting as long as possible.

The bottom line:

Compounding is a powerful tool for growing your money. You can take advantage of compounding by depositing your money in accounts that pay compound interest, or by investing in a dividend-paying stock and reinvesting the dividends you earn. Then you wait. The beauty of compounding is that you are rewarded for simply waiting and letting your money work for you.