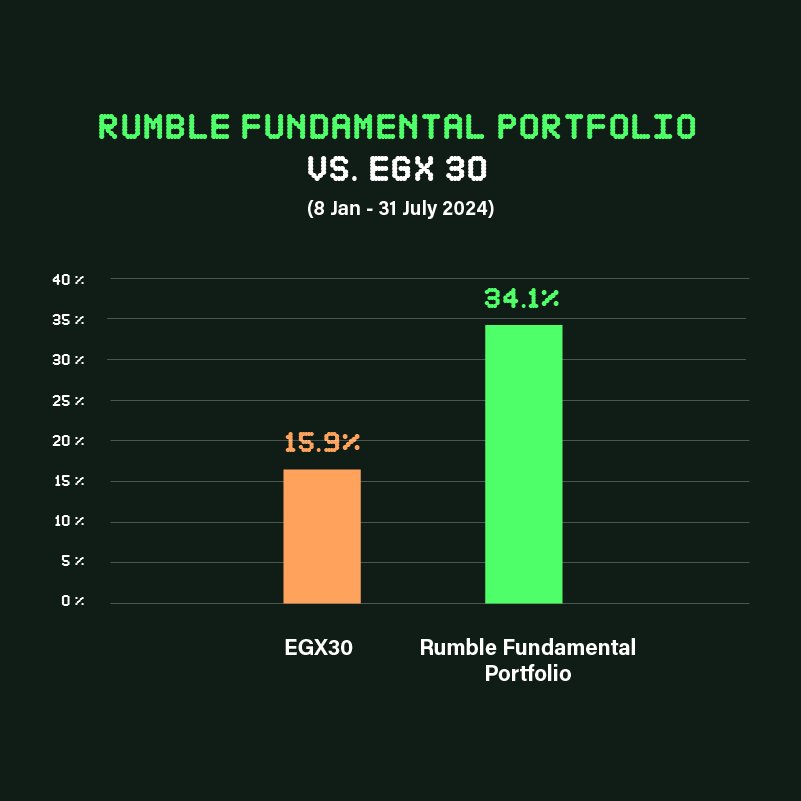

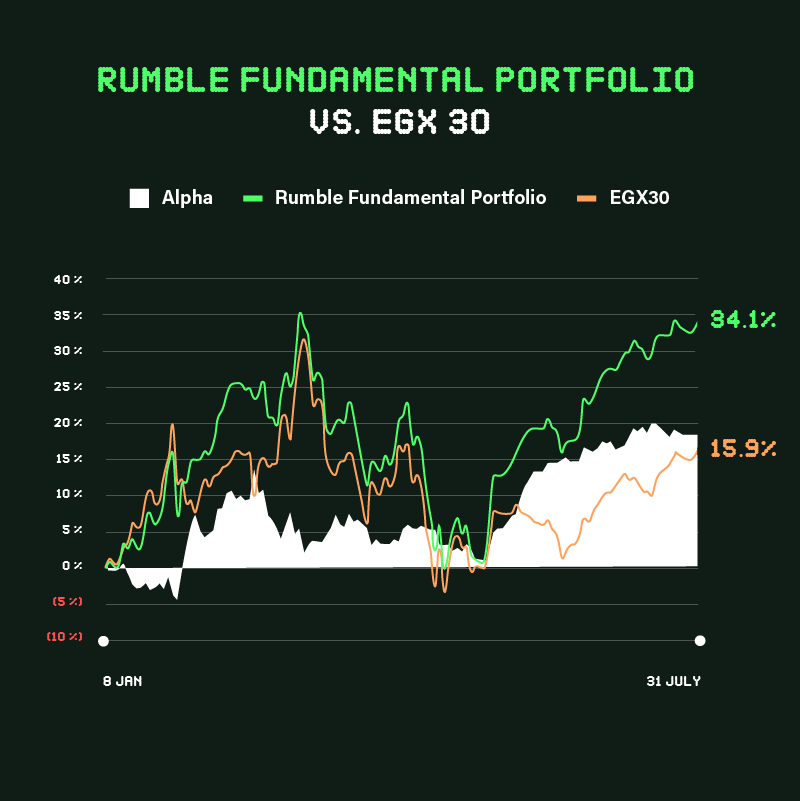

Have you ever wished that you could have an expert hand-select the stocks in your portfolio every month? Whether you’re a seasoned investor or just getting started, building a we balanced portfolio by choosing your own stocks can be tricky without expert guidance. That’s why we’re excited to tell you about one of Thndr’s featured themes—Rumble’s Fundamental Portfolio which outperformed the EGX30 by 18.2% since launching in January.

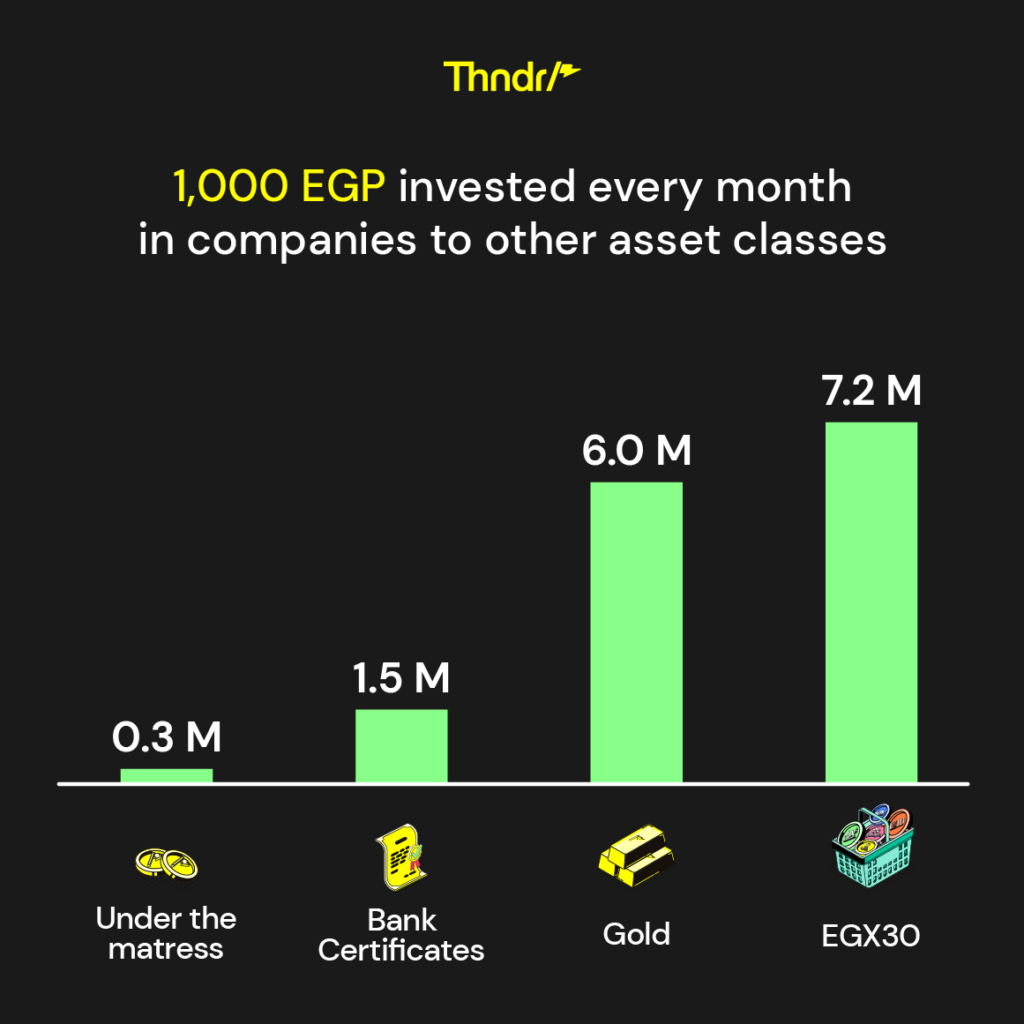

Why should I care about investing in companies anyway?

Investing in companies has proven to be the best avenue for building wealth over the long run.The biggest 30 companies in the Egyptian stock market outperformed other asset classes over a 25 year period from 1998-2024.

Please note that past performance does not guarantee future profits.

Expertly curated for you—Rumble’s Fundamental Portfolio

Imagine having access to companies picked by experts who advise millionaires. Rumble’s curated portfolio offers you a strategic and well-researched selection of stocks based on themes that are set to win in the current market conditions.

This portfolio is an exclusive product for Rumble users, and only 6 stocks from the portfolio are displayed on the Thndr app. Rumble will be sharing August’s updated full list with you for free! But, if you want to continue getting updates starting September you’ll need to to join Rumble.

Proven Performance

Let’s compare the returns you would have made if you had invested in the top 30 companies in the Egyptian stock market between Jan 2024 and July 2024 with the returns that Rumble’s Fundamental Portfolio has made in the same period of time.

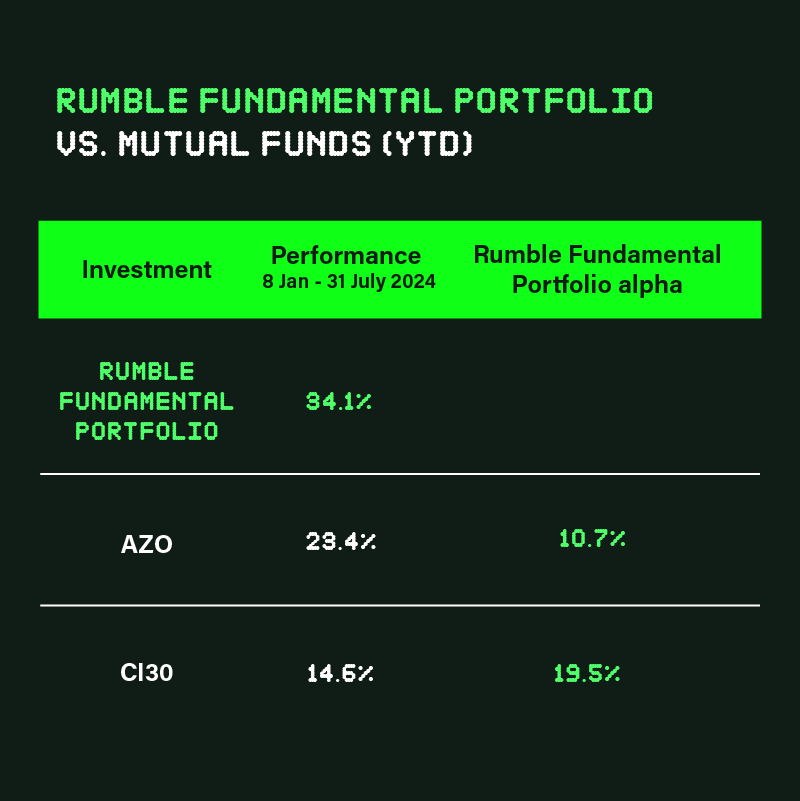

How does the portfolio stack up to some of the top equity funds on Thndr?

What’s the portfolio’s secret sauce?

Rumble’s experts have identified key market themes driving their stock selections. Each stock in the portfolio is chosen based on its potential within these themes, providing you with a clear understanding of the investment strategy.

- Banks and higher interest rates: Banks make more money when interest rates go up because they can charge more on loans than they pay on deposits.

- Export & commodity-linked companies: Companies that either sell or have their revenues linked to global commodities benefit more when global prices rise and USD appreciates vs. EGP.

- Low debt and strong cash position: Companies with little debt and strong cash reserves handle high interest rates better, especially if they have a net monetary asset position in USD.

- Ability to raise prices: Consumer companies that can increase their selling prices without losing many customers increase their profits even when costs rise.

- Defensive sectors: Companies in essential sectors like health care, utilities, and telecoms tend to have steady income even in tough economic times.

Steps to success

- Invest in the full portfolio: To make the most out of the portfolio and it’s diversified selection of companies and themes, invest in all 10 stocks in the portfolio.

- Invest regularly: Consider investing in Rumble’s 2024 Fundamental Portfolio on a monthly basis. This approach allows you to benefit from cost averaging and potentially capture opportunities during market fluctuations.

- Stay tuned for updates: The portfolio is updated monthly and Rumble notifies their subscribers of any changes as they happen.

You are now well on your way to making smart investment decisions and growing your wealth with confidence.

More than just a portfolio

Why subscribe to Rumble?

- Find strong companies to buy & hold through Rumble’s Fundamental Analysis Recommendations

- Find the best entry & exit points for stocks through Rumble’s Technical Analysis Recommendations

- Access expert-curated portfolios

- Access a library of exclusive content built with the goal of making you a smarter investor.

First month on Rumble is free. So, check them out & see for yourself.

Subscribe here

Download app [App store] [Play store]