Invest in Quantum Computing on ADX

Abu Dhabi, UAE — Listing Date 22 Sept 2025.

Lunate is launching QUANTM, an ETF tracking 25 companies shaping quantum computing. The index is designed and calculated by Solactive.

Why this matters

Quantum computing is not about “faster laptops.” It is a different way of computing that can explore many possibilities at once and solve specific, very hard problems dramatically faster than classical machines. Think molecular simulation, advanced materials, logistics, security, and grid optimization. Global public funding now exceeds $54B, and Big Tech plus startups are pushing toward a “quantum moment,” similar to where AI was in the early 2010s. Analysts estimate $1T–$2T in annual economic value by 2035.

Recent momentum includes Google’s Willow 105-qubit chip, IBM’s modular System Two, and Microsoft’s Majorana pathway to fault tolerance. The arms race spans the US, EU, China, and others, elevating quantum from lab focus to national strategy.

What QUANTM offers

QUANTM gives you diversified exposure to the full quantum value chain:

- Pure-play quantum innovators (e.g., IonQ, Rigetti, D-Wave, Quantum Computing Inc.).

- Big Tech with deep quantum R&D (e.g., Alphabet, IBM, Microsoft).

- Hardware, systems, and post-quantum security firms that enable or commercialize quantum.

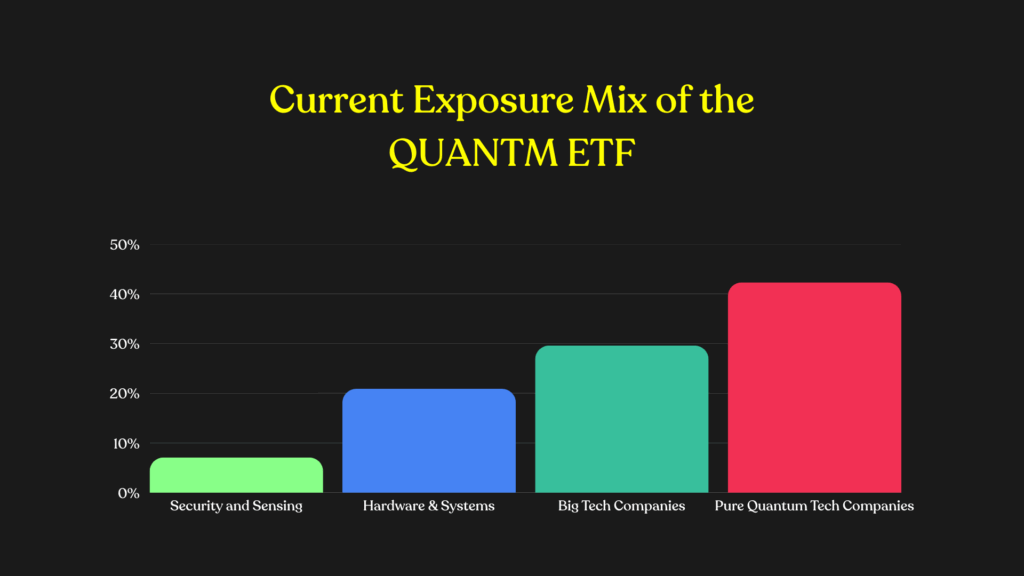

Current exposure mix

- By segment: 42.3% pure quantum tech, 29.6% Big Tech, 20.9% hardware and systems, 7.1% security and sensing.

- By size: 40.5% large cap, 10.4% mid cap, 49.1% small cap. The goal is broad participation across the ecosystem while smoothing single-stock volatility.

How the index is built

The Solactive Developed Quantum Computing Index starts from a developed-markets universe, then uses ARTIS, Solactive’s NLP tool, to identify companies with meaningful quantum exposure across hardware, software, communications, and sensing. The top 25 names by thematic relevance are selected and relevance-weighted with caps. The approach targets high thematic purity while avoiding concentrated bets on any single company or sub-technology.

Historically, the index has captured upside around breakthroughs while reducing the extreme drawdowns seen in individual pure-plays. It is a high-conviction, higher-volatility theme, designed as a satellite alongside a diversified core.

What could go right

- Breakthroughs in error rates, coherence, and scaling unlock practical “quantum advantage” for chemistry, finance, energy, and AI acceleration.

- Early leaders can enjoy outsized value capture, similar to GPU vendors during the AI boom.

What could go wrong

- Technical risk: fault-tolerant quantum may take longer than expected; qubits are fragile and scaling is hard.

- Execution risk: algorithms and real-world use cases may lag hardware progress.

- Market risk: early pure-plays can be volatile and reliant on funding cycles.

Key facts about QUANTM

- Index provider: Solactive (Germany)

- Holdings: 25 companies, rebalanced periodically

- Methodology: ARTIS relevance-weighting with caps

- Expense ratio: 0.49% annually

- Listing date: 22 Sept 2025

- Exchange: Abu Dhabi Securities Exchange (ADX)

What you can do today

- Open a Thndr account and complete verification.

- Buy shares in QUANTM starting 22 September 2025.

- Plan your allocation alongside your core holdings based on your conviction in the technology.

QUANTM ETF: Invest in Quantum Computing on ADX