Thndr has always been an investment platform, designed to make investing more accessible and intuitive for everyone. From the start, we focused on simplifying the investment journey by offering a user-friendly, interactive and educational experience that removes the complexities traditionally associated with financial markets, by helping people invest in different types of securities.

More than a year ago, we observed a recurring behavior among our users – they were using Thndr not just for investing but also as a place to “set their money aside” on their Thndr Wallet until they were ready to invest. Many referred to this habit as “keeping money in their drawer”: a safe space where they could park their funds before making their next financial move.

This insight reshaped our perspective on how users interact with Thndr. It became clear that Thndr wasn’t just an investment platform—it was also a de facto savings tool. But we knew this “drawer” experience could be more purposeful, intuitive, and visually appealing. Instead of just being a passive holding space, what if it could actively help users manage and grow their money?

That realization set us on a path to rethink and enhance this behavior, transforming the drawer from a simple waiting spot into a powerful, structured savings experience.

Research by economist Richard Thaler explores the notion of ‘mental accounting’. The findings are exciting and show that earmarking funds makes saving easier by budgeting your savings and rethinking spending patterns. We tried to mimic this behaviour with our Savings Clouds, allowing users to organise their funds into dedicated buckets – emergencies, a new car, summer trip.. – keeping funds liquid while preserving a mutual fund core.

Why a mutual fund core? At Thndr, this decision was driven by several key reasons. As an investment-first platform, we’re committed to reshaping the way people think about saving and investing. By integrating a mutual fund into the Clouds experience:

- We’re making funds more approachable and effective for users looking to grow their savings with confidence.

- Ensuring regulatory greenlight since mutual funds are well-established, regulated investment vehicles that offer transparency and security, operating within our license, making them a natural fit for Clouds.

Savings Clouds go beyond just convenience – they’re designed to deepen user engagement, boost retention, and support financial well-being by making goal-based saving an integral part of Thndr. When users actively allocate funds toward their personal goals, they’re not just saving – they’re building a stronger connection with our ecosystem. By aligning their financial habits with meaningful objectives, we create a more engaging and rewarding experience that keeps them coming back.

The Product Cycle

Building products isn’t easy – if it were, we’d have fewer meetings and a lot less grey hair. Here’s what we did:

- Identify an Issue

To build a better experience on Thndr, we’re always looking at how users interact with the platform. One key focus area is understanding withdrawals – why users move their money out and what would make them park more of it on Thndr, and for longer.

By gathering data and speaking with our users, we’ve been exploring ways to encourage more deposits and make Thndr a place where people feel confident leaving their money. Through this process, we’ve realized there’s plenty of room to improve.

Our withdrawal survey revealed that 50% of users with decreasing monthly deposits leave their withdrawn funds as idle cash outside of Thndr, indicating a missed opportunity to retain these balances within the Thndr Wallet.

- Empathize

The survey helped us spot a gap, but it could only tell us so much. To really understand our users, we had to speak to them.

After conducting user interviews and calls, we found that users withdrawing had described Thndr’s investment wallet as a ‘drawer’ – a temporary place to hold funds while they explore new opportunities, whether for investments within Thndr or savings elsewhere. They also expressed a preference for not using these funds for daily expenses.

- 20% of users referred to Thndr as a ‘savings drawer’

- 100% of users expressed that they were waiting for an investment opportunity

- 50% of users expressed disagreement with current saving alternatives

Thndr User: Fund Flow

- Define

Time to brainstorm! With the problem clearly outlined, we shifted our focus to finding the solution (the How). We needed to address and solve the following challenges for our users:

- How to benefit from keeping idle cash on Thndr

- Have easy access to those funds, ready for any investment opportunity

We believed that offering a high-liquidity savings experience would help retain users. Psychologically, it aligned with behaviors they were already familiar with. We wanted to reward them for keeping idle cash on Thndr.

Economically, this approach leveraged the concept of opportunity cost for the user – rather than keeping idle cash in low yield savings or withdrawing it prematurely, users could maximize their returns while maintaining liquidity. By offering a high-liquidity savings option, we aimed to reduce the friction between saving and investing, increasing the velocity of money within Thndr’s ecosystem. This not only incentivizes users to retain funds on the platform but also reinforces the principles of capital efficiency creating a more sustainable financial habit.

Our goal? Making saving second nature.

- Ideate

With our creative hats on, we began envisioning what this would like on Thndr. We knew the direction we wanted to take, but we needed to figure out how to make it fit. As a start, we identified key user needs and considerations:

- Frictionless Experience – Saving should be simple, not overwhelming. We wanted to design a seamless flow for users to allocate and track their savings effortlessly.

- Clear Separation Without Restriction – Users shouldn’t have to choose between saving and investing. We need to allow them to grow savings alongside investments.

We wanted to build something that felt both fresh and familiar – beyond investments, but still unmistakably Thndr.

- Build & Iterate

This led to the first version of Savings Clouds – just called the Savings Wallet. (Back then, the only clouds we knew of belonged to Google and Apple).

We built a simple wallet interface showing user balance – a basic MVP. Our hooks:

- Steady returns on idle cash

- Instant transfers to their investment wallet for new investment opportunities

MVP: Savings Wallet

Sounds great, right? Well, turns out… it wasn’t.

Most users weren’t hooked.

After listening to our users and gathering feedback, we realized there was plenty of room to improve. Here’s what we learned from our MVP:

- Psychologically, users saw it differently from an investment – goal achieved, no need to engage further.

- It lacked emotional attachment. There was nothing special about the experience – it felt too basic. (Learning: MVPs don’t have to be boring).

- Users wanted to track progress and see growth, which we didn’t offer.

We had built an average product.

I was then reminded of a quote I previously heard: “Your feature is an average of its components, not its sum” [from Spotify: a Product Story]. That hit home. We had good individual hooks, but put together, the overall experience was just… okay. And okay wasn’t enough.

So, we went back to the drawing board:

- We gave users progress visibility of their expected savings growth and actual lifetime gains. This reinforces habits and keeps users committed.

- We integrated goal-setting, helping users take control of their savings and track progress.

- We added categorization, allowing users to split savings into buckets and work toward specific goals.

- We redesigned the interface to make it fun, interactive, and engaging.

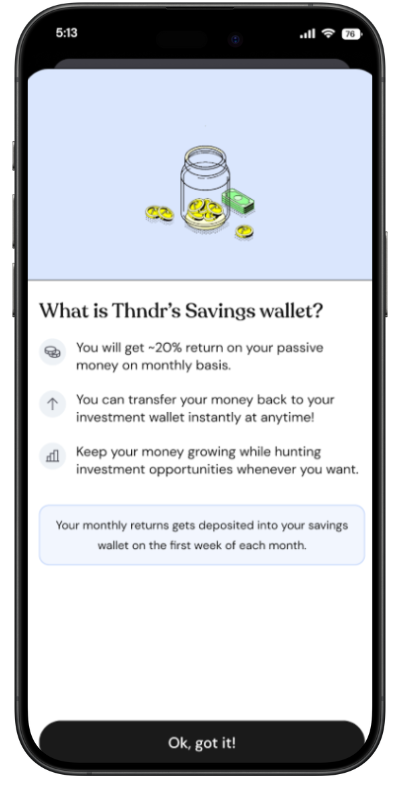

- We revamped onboarding, shifting from a bottom sheet in our MVP to a story-like experience that excited users and clearly explained the hooks.

6. Deliver

And so …drum roll… Savings Clouds were born! (With a name like Thndr, adding Clouds was the natural next step).

A feature that not only keeps users’ savings intact but makes the experience rewarding, engaging, and an integral part of Thndr’s ecosystem.

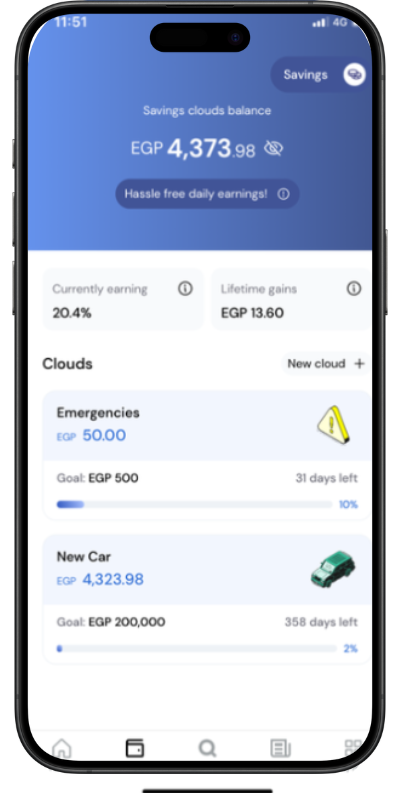

Savings Clouds

Savings Clouds

MVP: Savings Wallet Savings Clouds

For the main screen, the MVP solely emphasized balance visualization, which didn’t add much value to users. To enhance clarity and engagement, we upgraded the look and feel, and highlighted key metrics through placeholder cards on the main screen:

- Currently Earning: An automatically updating percentage reflecting daily fund performance – annualized based on the prior 30 days.

- Lifetime Gains: A progress tracker reinforcing a sense of accomplishment.

- Clouds List: A clear view of savings across different categories.

Progress Bar: A visual motivator, encouraging users to add more as they approach their goals.

MVP: Savings Wallet Savings Clouds

The Savings Wallet top-up experience was simple and straightforward but this led to low user attachment. Users saw it as just another money movement, lacking a sense of achievement or celebration. The revamped Cloud creation flow fostered a sense of ownership, making users feel more engaged in the process, which led to a higher user return rate.

MVP: Savings Wallet Savings Clouds

The onboarding experience has evolved significantly. Initially, the MVP used a simple bottom sheet with bullet points, but user feedback revealed that most ignored it. To drive engagement, we transitioned to a story-like experience, making it more interactive and exciting for users.

User Behavior Changes

So far, the results have been promising:

- Our MVP had an engagement rate (% of users interacting with the feature) of 2%, while the Clouds have an engagement rate of 10%

- Our MVP had Savings Clouds users deposit 3x higher rate compared to users that didn’t interact with feature, while the Clouds has users deposit 10x higher deposit rates

- Currently consisting of 80% of the cash of Thndr users interacting with the feature (average wallet contribution)

Thndr Users: Wallet Contribution [%]

What’s Next?

We’re committed to continuously improving Savings Clouds to deliver the best experience for our users. As we refine this feature, we’re focused on making saving not just instinctive, but completely seamless and actionable. Fintech isn’t just about providing tools – it’s about building experiences that make financial health effortless and long-lasting.

And Savings Clouds are just the start

How do you design for better saving habits in fintech? Let’s discuss on LinkedIn!

– Read more about Savings Clouds here!

– Interested in Thndr? Sign up here!