Since the Act Financial IPO was oversubscribed a little over 54 times – you got most of your money back and it’s sitting in your wallet, and you might be thinking of sending it back to your bank account. But, is that really the smart thing to do with money you have no immediate use for? Instead of parking it in the bank, you can leave it on Thndr to grow in a savings fund backed by Egypt’s top fund managers.

Thndr is a great way to grow your savings

Our savings funds are easy to access & 100% safe to use and give you up to 22% per year* – the best part is you can withdraw your money whenever you’d like – this means your money is never tied up! We even have Sharia-compliant options.

Let’s say you got EGP 10,000 back to your wallet after your ACTF allocation; and you decided to put it in a savings fund on Thndr and forget about it for a year. When you check back in, you would have made an extra EGP 2,200 just like that.

In other words, it’s like saying you would have lost EGP 2,200 if you didn’t save your money on Thndr.

*One month annualized returns for MTF as of July 23 2024.

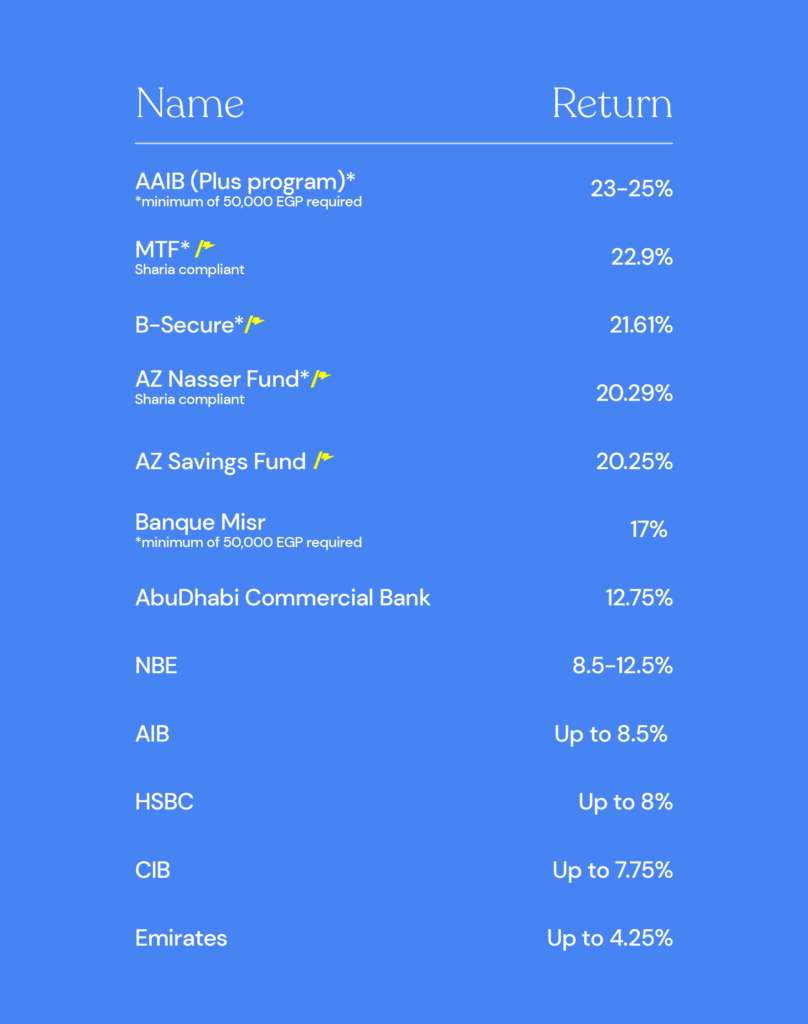

How does that compare to what my bank savings account offers me?

Let’s take a quick look at how we stack up against Egypt’s biggest banks:

Thndr savings products’ return VS. Egypt’s largest banks’ savings return:

*Annualized 1 month returns as of July 23 2024

But, a bank certificate would give me more? That depends on how you define more.

When it comes to choosing between saving on Thndr or with a bank certificate, there’s just one question you need to ask yourself. Would you rather;

- A. Watch your money grow daily and liquidate it easily whenever you’d like

- B. Earn just 1-2% percent extra but tie it up, with no access, for a whole year or more?

The choice is yours, but let us explain how each works:

Bank certificates lock your money up for a year or more. If you want to add or withdraw any money, you’ll have to pay a hefty penalty to break the contract. With savings funds on Thndr, you can withdraw and add money as you please in a couple of taps, and choose the savings funds that actually give you almost the same return; and the best part is – all our savings funds’ returns are daily, which means you can literally watch your money grow day by day.

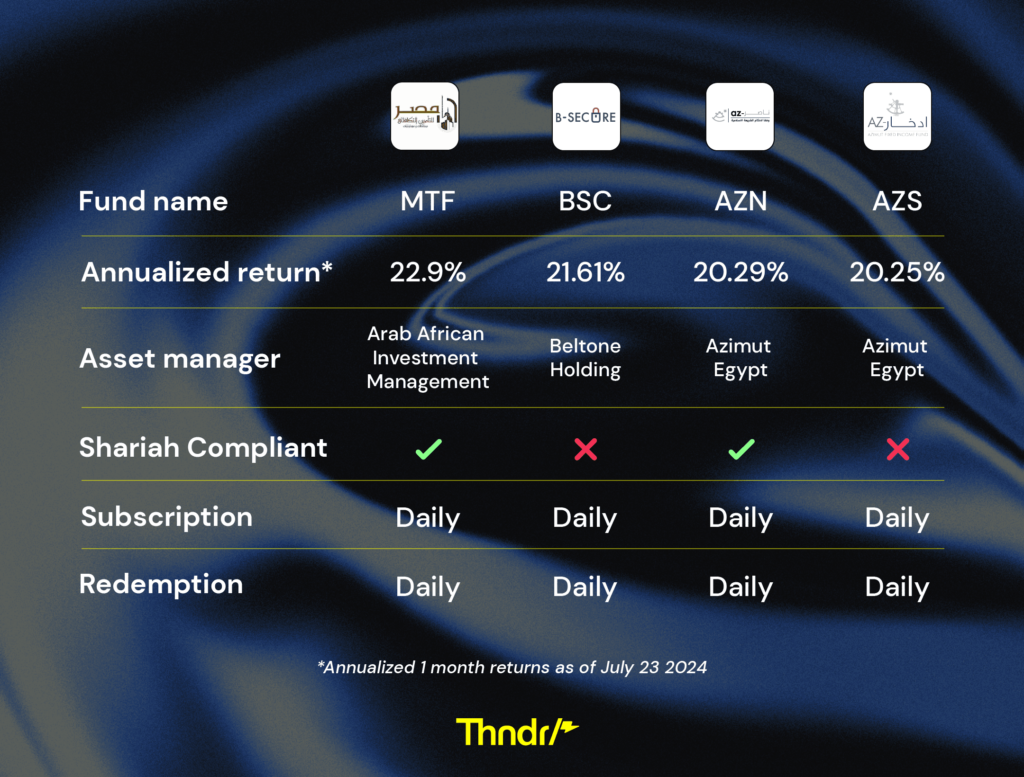

If you’re sold on savings (pun unintended) – but don’t know which one to choose; here’s the TLDR comparing each one of the products we have on Thndr

(disclaimer: we’re always adding new products)

And as a final note, watch our video below featuring CEO, Ahmad Hammouda on why NOW is actually the best time to save.

You can discover all of our savings funds on the Thndr app by visiting the savings theme on your explore page.