If I don't invest - what will happen to my money?

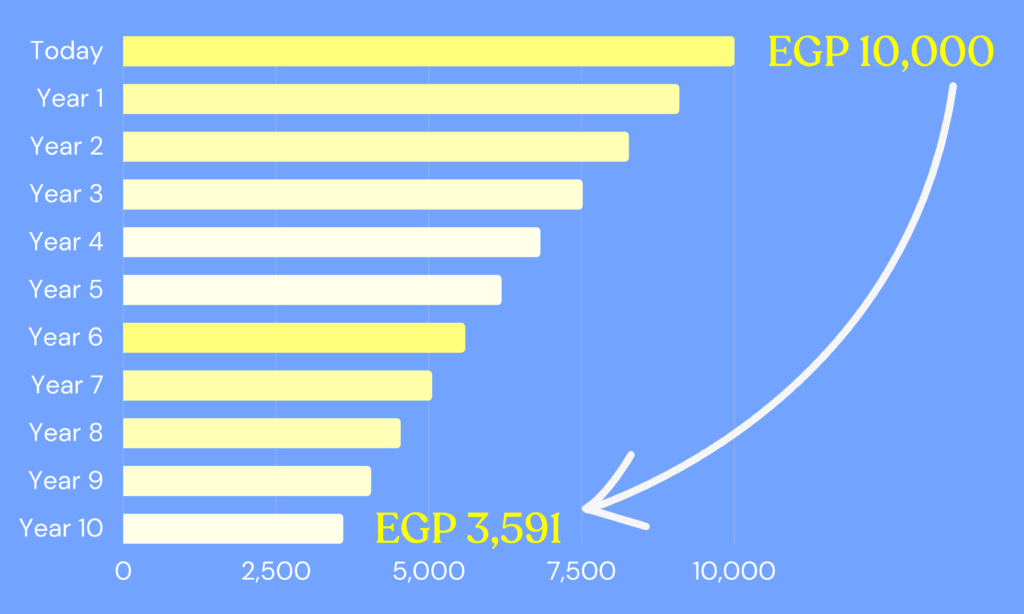

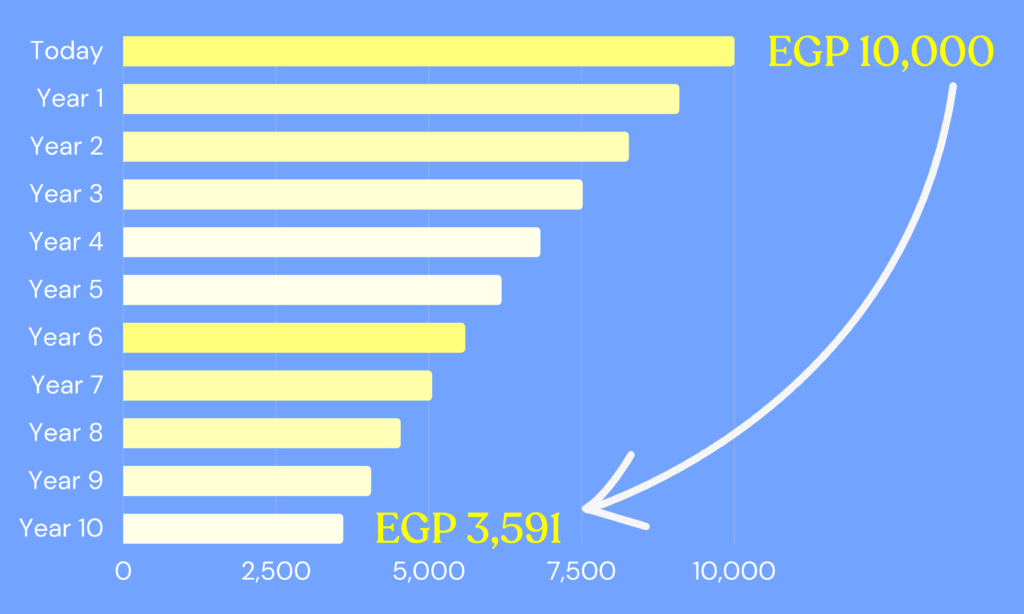

Let’s assume that the inflation rate is at 10% – and you have EGP 10,000 saved up, uninvested. After 10 years, those same EGP 10,000 would be worth EGP 3,591 today.

If you’d like a quick intro on investing – watch this video. To get the full experience, keep scrolling and we’ll take you through everything you need to know.

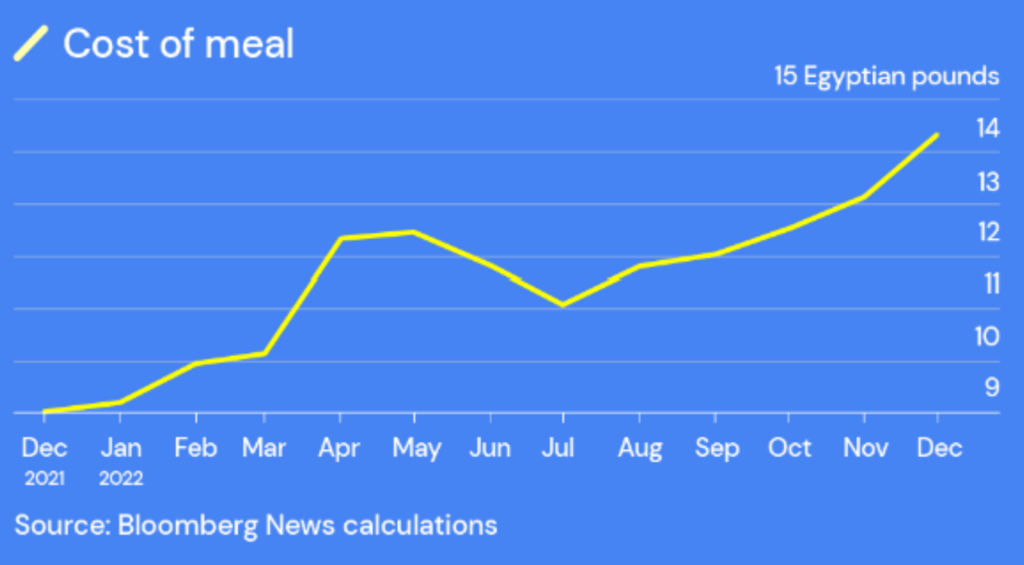

The price of koshary has gone up by around 60% in the past year – you need almost double the money today to buy the same plate of koshary.

The inflation rate in Egypt is currently at a whopping 32.7%% (according to the Central Bank of Egypt).

Let’s assume that the inflation rate is at 10% – and you have EGP 10,000 saved up, uninvested. After 10 years, those same EGP 10,000 would be worth EGP 3,591 today.

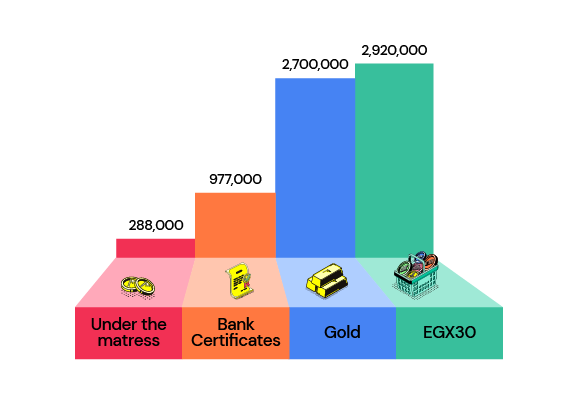

Let’s imagine 4 people. Each one of them put aside EGP 1,000 every month, from 1998 to 2021 (for 24 years)

These numbers are based on a study conducted by the EGX from 1998 – 2018, and Thndr extended it until 2021.

*Money invested on the long run is money you don’t need in the near future, giving you the power to decide when to withdraw it.

We’ll make you believe investing is right for you, show you how to start, help you put a plan in place.

Risk is your likelihood of getting the returns you expect.

The borrower promises to pay you back at a later date + a fixed interest. It’s considered low risk because you’re promised to be payed back an exact amount (the level of risk depends on who the borrower is). Eg: Treasuries, CDs.

When you own something, it’s value can go up or down depending on its performance. You’d look to buy something with the expectation that it would go up in value. This applies to purchasing a share of a company, gold, real estate, and even art.

The EGX30 made double the returns of the 18% CD, from 20/03/2022 – 20/03/2023.

Here you’re promised 18%, no more and no less. Risk is low because you’re guaranteed those exact returns, but the returns are also low.

Your returns depend on the companies’ performance. Risk is high because you can’t guarantee how much you’ll make, however there is no cap on how high your returns can be.

You should be setting aside 10-20% of your income every month to save or invest. This is your foundation – the very first and most important habit you should build in order to start investing. This money is for ‘future-you’, you’ll thank yourself later.

A good way to hedge against inflation is by investing in gold. Gold prices tend to move up during times of economic instability and inflation – when fear is up and the general sentiment is down.

15% of the money you set aside monthly for your savings & investments, should be invested in gold.

Building a solutions fund is essential – this is money that you set aside, to cover your essential living expenses for 6-12 months, in case of emergencies or unexpected expenses.

You should save this money in a way that offers liquidity, and protects it from losing value.

You can do this by investing in fixed income mutual funds – they give you an almost guaranteed return, and the ability to withdraw your money daily/weekly.

One of the best avenues to grow your money and generate wealth is investing in companies, for the long term.

It’s best to do this with money that you know you wont need in the next 3-5 years. In order to grow your money with high returns, you’ll be exposed to high risk – a longer time horizon would help you mitigate that risk.

When you make returns that are higher than inflation, that means you’re growing your money – its increasing in value.

There are many different ways to invest in the stock market, depending on your objectives, and how much time you can dedicate towards investing. You can either invest:

A mutual fund is where many people pool their money together, and an expert (aka an asset manager) is responsible for investing it on their behalf. Each mutual fund is different – some invest in companies, others invest in bonds or gold, etc.

Regardless of whether you invest EGP 10 or EGP 1M, all the money is pooled together, and the asset manager’s job is to put that money to work for you. Mutual funds are a great way to start investing in companies, since you delegate that task to a licensed professional.

These funds invest in an index – like a leaderboard that tracks a list of companies. It captures the whole market, or a subset of the companies in the market. Basically, these funds don’t pick and choose which companies to invest in. They simply follow an index, and invest in the companies that fall within that list.

Eg: Misr Equity Fund (CI30). This fund invests in EGX30, the 30 largest and most traded companies in the EGX.

These mutual funds actively pick and choose the companies they invest in. They have a team of analysts continuously dedicated to selecting the best investment opportunities that are in line with the fund’s mandate and strategy.

Eg: Azimut Opportunity Fund (AZO)

Identifying the right investment opportunities needs a lot of homework—research, understanding business models, and keeping up with the news.

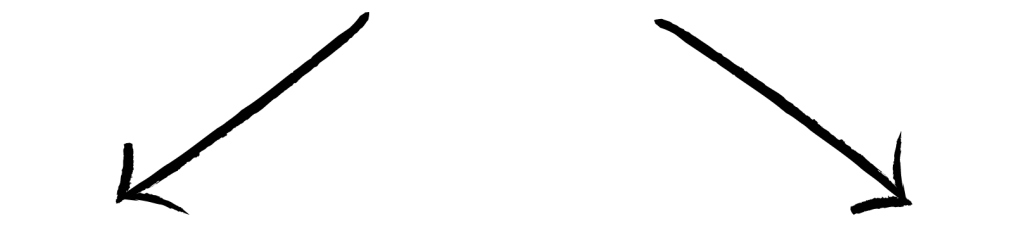

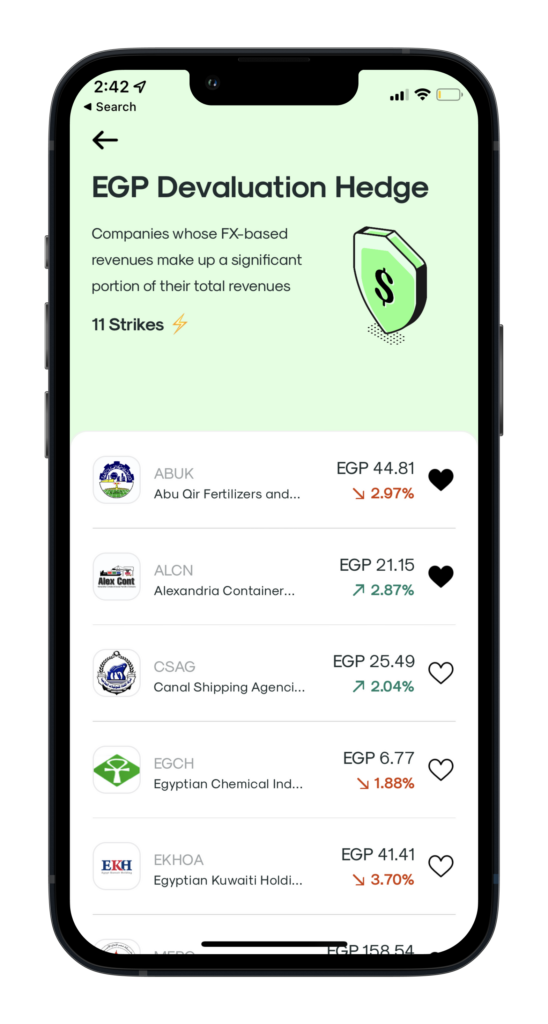

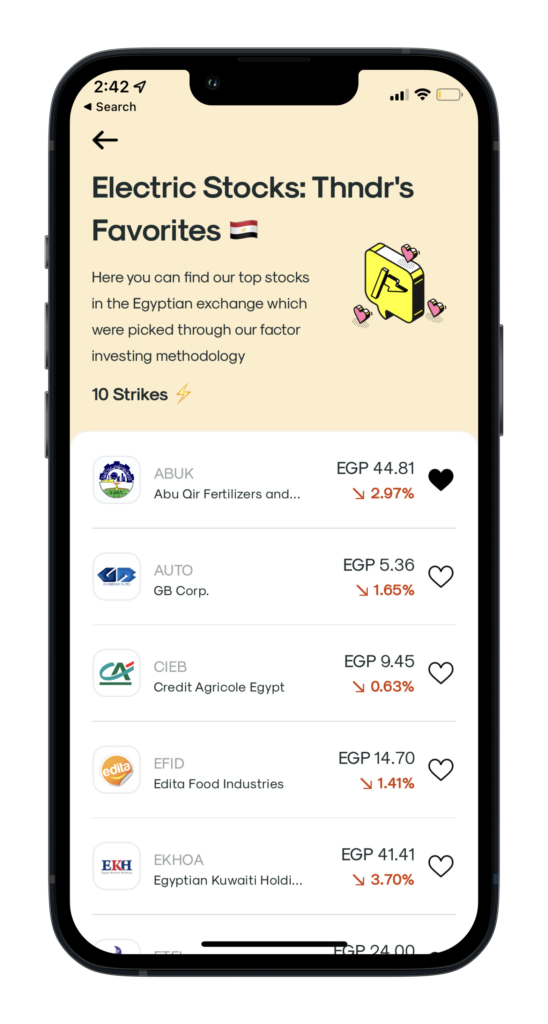

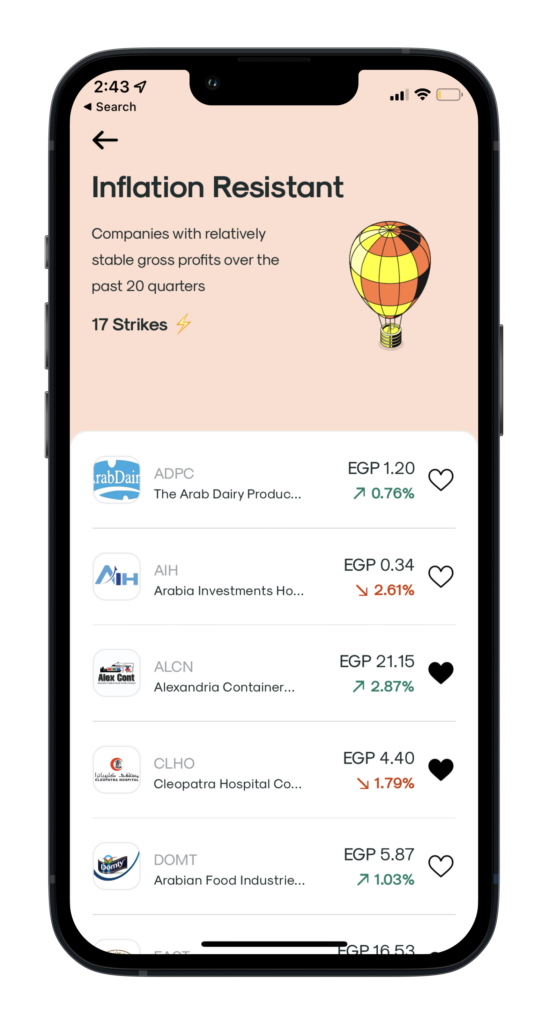

Themes are lists of companies we created to help you find investment opportunities. Each theme is based on certain criteria. For example: the ‘Inflation Resistant’ theme includes companies that are predicted to outperform others during high periods of inflation.

You can find these on the Thndr app, and use them to choose companies based on your own objectives.

We’d love to reach out to you for any upcoming courses, videos, or sessions you may like.

Book your spot to attend a live session about the basics of investing, where we’ll also be answering your questions in a Q&A.

All investment involves risk. The information contained on this page is not financial advice. You should always do your own research before making any investment decisions. The Thndr platforms and brand name are the property of Axis Markets BV. Trading in Egyptian Financial Securities is done through Thndr Securities Brokerage, authorized and regulated by the Financial Regulatory Authority. Trading in US Financial Securities is done through Alpaca Securities LLC, authorized and regulated by the member FINRA/SIPC.

This information is for educational purposes only and is not a recommendation or a solicitation to invest. The value of investments can go up and down and involve risk. Thndr does not provide investment advice and individual investors should make their own decisions based on their research or seek independent advice. Thndr is the trading name of Thndr Securities Brokerage which is authorized and regulated by the Financial Regulatory Authority (FRA). Registered in Egypt (no. 804).