Is the search for a risk-free investment truly a mirage? A chase after an illusion you’ll never reach? Even though no investment is 100% risk-free, the good news is there are some you can call *almost* risk-free. These *almost* risk-free investments are called fixed income securities.

Before we start – what is risk?

When it comes to investing and other things, risk just means”the chance things don’t go according to plan”. Basically, it’s the uncertainty of whether or not you’ll get the return you’re hoping for. To understand risk, you need to consider two main things:

- Your ability to calculate how much money you’ll potentially get back (visibility)

- The chances of actually getting that money (likelihood)

The catch is—the more risk you take on, the higher the payout. But, of course, there’s also a bigger chance things could go wrong. On the flip side, lower risk investments are a bit more secure, but the returns aren’t as big.

Let’s say you’re trying to decide between two options. One is a low-risk savings account with a guaranteed interest rate, but the returns are just okay. The other is investing in your friend’s startup, which is riskier but could bring in a much bigger payout if it succeeds. It’s all about your goals and how much risk of not meeting this goal you can handle. It’s about finding the balance between the potential risks and rewards and choosing the best fit for your financial goals.

What investments are considered *almost* risk-free?

Ever heard the term ‘fixed income securities’? If you take a second you’ll see that they are exactly what the name implies— investments that promise to pay a fixed amount of money at regular intervals. Simply put, through these “fixed income securities” you get to lend money to a company or government and in return, they promise to pay you a set amount of interest at regular intervals. Both companies and governments need money t to finance their operations and projects, and if you want an *almost* risk free source of passive income— it’s really a win-win situation.

Is lending considered a type of investment?

There are 2 ways to invest – either through ownership, or lending. Let’s put this another way, imagine your friend is starting a pizza place, and needs $1000 to start. You want to pitch in to help him raise that money, and make some money too.There are 2 ways to do that:

Option 1 – Lend your money: You give your friend a $500 loan to fund his project, where he agrees to repay you in a year, plus 20% interest (so you get $500 back plus another $100 in interest). Whether your friend’s restaurant becomes a huge success, or fails miserably—they will still have to pay you the exact amount you agreed upon—$600. This way of raising money is called ‘debt’.

Option 2 – Become a partner: You find a friend who is opening their own business, and offer to become a part owner. You pitch in $500, in exchange for 20% ownership of the business. If the business succeeds, there are no limits to how much money you can make. However if it fails, you could easily lose your whole investment. You win together, and you lose together. This way of raising money is called ‘equity’.

These are the same options that companies and governments use to raise money to fund their projects. Going back to our definition of risk, you can see that the first option gives you better visibility on how much money to expect back, making it less risky. However, the second option has much bigger potential for returns, and the returns are not capped.

How can I become a lender?

Lending the government – Treasuries:

Treasuries are loans that governments issue to raise money. They promise to pay back the money you loaned, plus some extra money (called interest), after a certain period of time.

T-bills are short-term loans to the government that have to be paid back plus interest. This is paid back in a year or less (either 3, 6, 9, or 12 months), and they’re usually used to finance deficits.

T-bonds are long-term loans to the government that have to be paid back in over 1 year – they usually use these to finance big projects for example: the new monorail in Cairo. In addition to getting your money back, you also get a fixed payment every 6 months or 1 year. These are like a long-term savings plan, where you get paid interest over time, and then you get the entire amount you loaned back plus the promised percent increase after a set period of time.

You can buy and sell treasuries through your bank, learn more about this here.

Lending companies – Corporate Bonds:

When you buy corporate bonds, you’re essentially giving the issuing company a loan. In return, the company agrees to pay you a set amount of interest, also known as a coupon, and they agree to return your original investment at a specific date in the future. Each corporate bond can have a different duration and returns, that are predetermined by the company. You can find listed company bonds in Egypt here.

To assess the likelihood of a borrower defaulting (aka not being able to re-pay) on its outstanding bonds, bonds are assigned a credit rating by rating agencies to help investors determine the riskiness of the bonds. These ratings are given to companies as well as governments, by rating agencies such as Moody’s and Fitch Ratings.

Lending banks – Certificates of Deposit (CDs):

A CD is like a special savings account you get at the bank. You lend the bank your money for a predetermined amount of time (e.g 1 year), and in return, the bank promises to pay you a set amount of interest (this can be monthly or annually). This interest rate is usually higher than a regular savings account. And, since CDs are offered by banks, your money is closely monitored by the Central Bank, making it low risk. It’s a safe place to keep your money, but you can’t access your invested money until the CD term is over—unless you pay a penalty. This means CDs aren’t very liquid – more on that here.

How can I become an owner?

Becoming an owner – purchasing stocks in companies

One way to become an owner is to invest in companies – through buying stocks on the stock market. A stock represents partial ownership in a company. Let’s say you buy 1 stock in Fawry, for EGP 5. You are now one of the owners of this company, the value of your investment can go up or down, depending on the company’s performance.

Note: this isn’t the only way to become an owner, there are many other ways – such as owning real estate, or starting your own business.

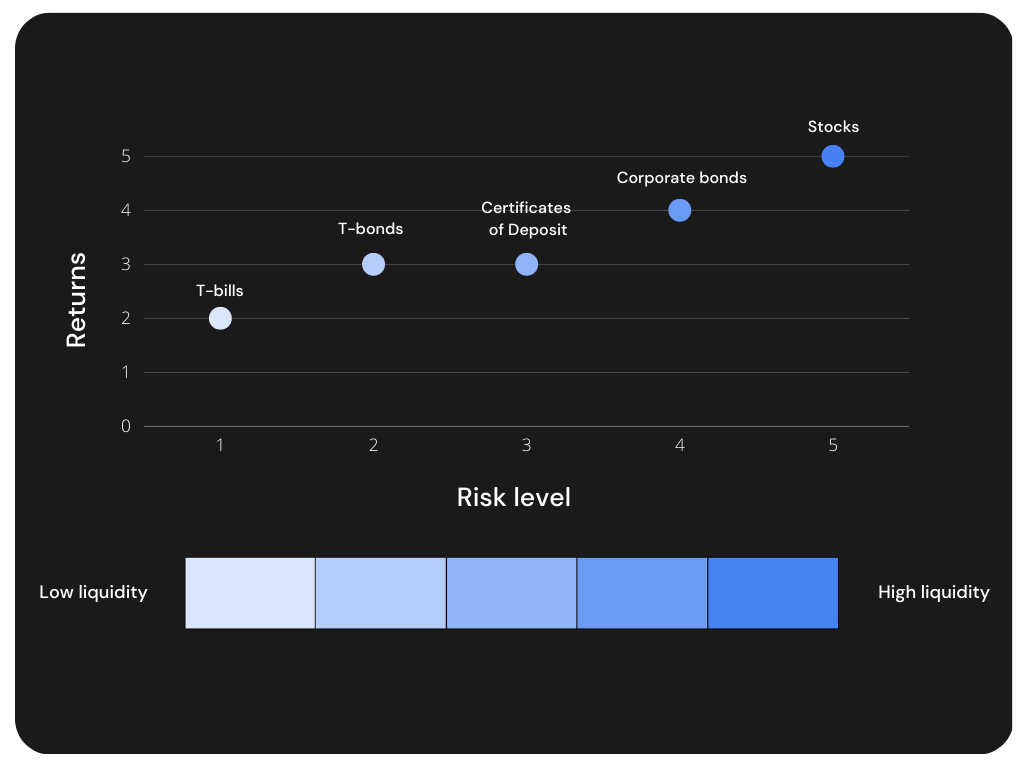

How do these investments compare to each other?

Let’s take a look at how these investment types compare to each other, in terms of:

As you can see, each type of investment has a different level of risk and return. If what you’re looking to add to your portfolio is a lowest risk option, then lending the government (aka treasuries) is the way to go. Learn more about them here.