Looking to grow your wealth? Try investing in stocks

Think of stocks as the muscle-builders of your financial health. Just like working out regularly builds physical strength, investing consistently in stocks can help you build wealth.

Watch this video to find out how investing is for you. Want the full experience? Keep scrolling for more

We all have goals, and goals cost money. But here’s the thing, most of us were never taught how to manage our money – which is crazy, because it’s one of the most valuable skills we can learn! And that’s what we’re here to help with.

Pick your goal and let’s get started!

Get behind the wheel of your dream car. Make your move and hit the road!

Plan for your child’s future now. Start saving for their education today!

Take the first step toward homeownership. Start planning your future today!

Ready to explore? Set your travel goals and make memories that last a lifetime!

A lot of people think they need to be wealthy before they start investing, but that’s like saying you need to be in great shape before you can start working out. Just as you exercise to improve your physical health, you invest to build your financial health.

Begin by setting aside 10-20% of your income each month for investing. A good budgeting hack is to follow the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and investments.

Think about it; do you have to study physical education to work out? No, right?

There’s a bunch of different ways to start working out if you’re a beginner, and investing is just the same.

Think of the bank where you have your account, the food brands you trust, or the construction companies building the cities you live in.

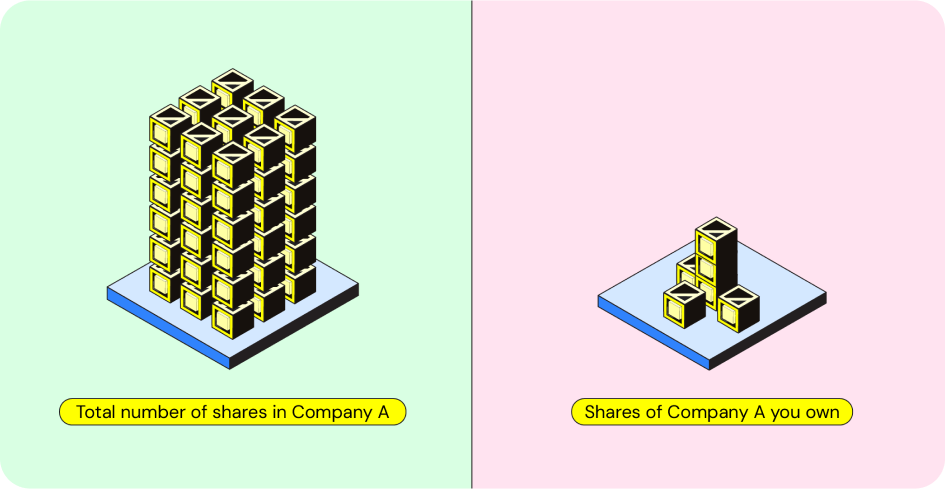

A stock represents partial ownership in a company. By owning a stock, you own a little piece of that company.

The stock market acts as a middleman between companies who want to raise money, and people like you and me, who want to invest their money and create wealth.

Think of stocks as the muscle-builders of your financial health. Just like working out regularly builds physical strength, investing consistently in stocks can help you build wealth.

Whether it’s a down payment on a home or a dream vacation, our savings products are designed to help you reach those milestones. Like setting aside money in a piggy bank, but with better returns.

Gold is like your financial shield, especially during crises. Take the COVID-19 pandemic, for example—gold has historically held its value, even when the economy took a hit.

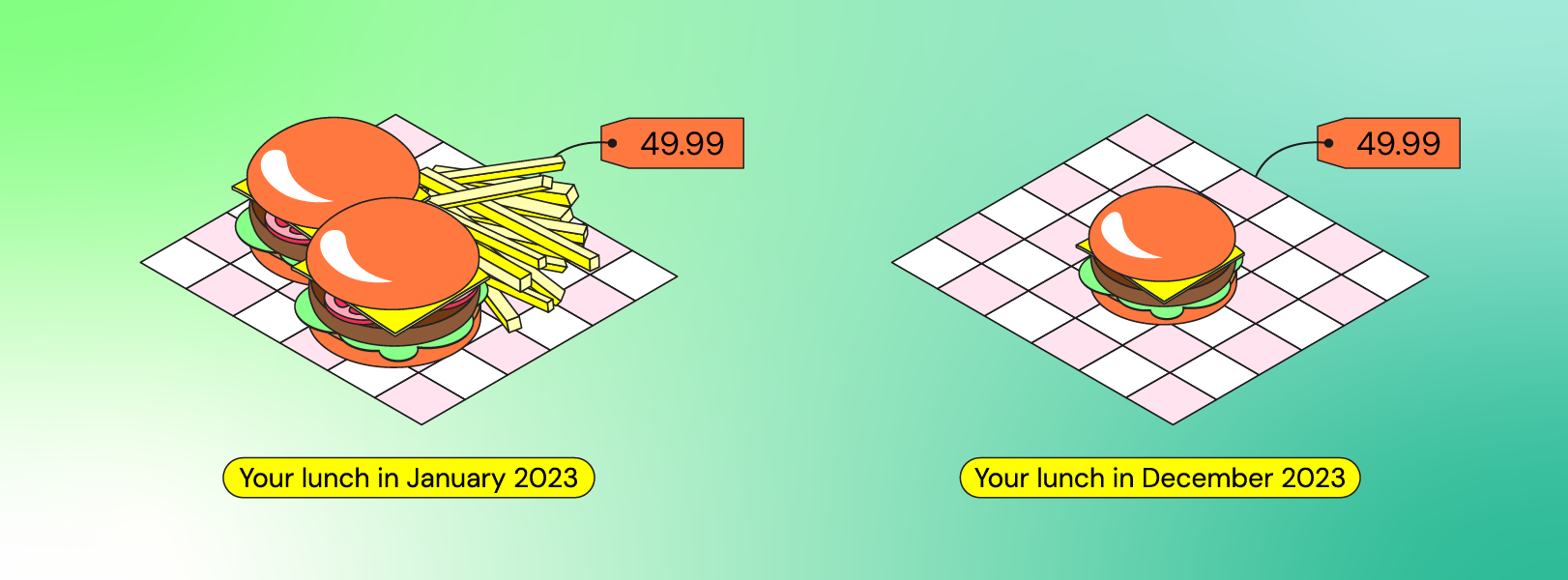

Over the past few years, inflation in Egypt has surged, with rates hitting double digits- highest at 36%.

Let’s say you had 10K EGP saved up at the start of 2023. Because of inflation, that amount would have been equivalent to around 6K EGP by the end of that year.

All investment involves risk. The information contained on this page is not financial advice. You should always do your own research before making any investment decisions. The Thndr platforms and brand name are the property of Axis Markets BV. Trading is done through our regulated entities: Thndr Securities Brokerage in Egypt, regulated by Egypt’s Financial Regulatory Authority, and Thndr Financial Ltd, regulated by ADGM’s Financial Services Regulatory Authority.