“BUY the right, SELL the stock” is how existing MCRO shareholders can use the current mispricing to make a 40% profit, assuming they are in the stock for the long term.

26 November 2025

Amr Hussein Elalfy

In this note, we lay down an arbitrage strategy that shareholders in Macro Group [MCRO] can use to their benefit. MCRO is undergoing an EGP570mn capital increase with the following details:

- Rights trading: From 18 through 30 November 2025, after which they will expire.

- Subscription to the capital increase: From 18 November through 3 December 2025 for those who are rights holders.

Here is a link to the arbitrage strategy to apply at market price.

In sum, for existing MCRO shareholders, here are the decision rules:

| If the price of MCRO’s | is | The price of MCRO’s | then | Current status |

| right + 0.20 | lower than | stock | Buy the right then subscribe | Active |

| right + 0.20 | higher than | stock | Sell the right and buy the stock | Inactive |

Note: Arbitrage should be one right per one share.

Source: Rumble Research

How MCRO’s shareholders can benefit

What happened?

MCRO is currently undergoing an EGP570mn capital increase by issuing 2.85bn shares at a par value of EGP0.20 a share with no issuance fees. Thus, MCRO will be raising its paid-in capital from a current EGP114mn (570mn shares at a par value of EGP0.20/share) to EGP684mn (3.42bn shares at a par value of EGP0.20/share).

MCRO’s capital increase

| MCRO | No. of shares | Par value (EGP) | Paid-in capital (EGP) |

| Current | 570,206,456 | 0.20 | 114,041,291 |

| Subscription | 2,851,032,280 | 0.20 | 570,206,456 |

| New | 3,421,238,736 | 0.20 | 684,247,747 |

Source: Company reports, Rumble Research

The arbitrage strategy

In view of the current market prices, we are proposing an arbitrage strategy that is directed at existing MCRO shareholders given that MCRO’s right is currently trading at a deep discount to MCRO’s stock.

Who is it for?

This strategy is only applicable to existing MCRO shareholders who:

- Currently own MCRO shares.

- Intend to hold on to their MCRO shares for at least the next 2-3 months.

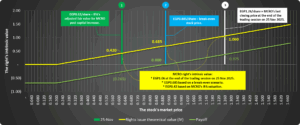

MCRO’s tradable rights intrinsic value vs. payoff

Source: Rumble Research

Key price levels to keep in mind

| No. | MCRO (stock price) | MCROr (right price) | MCROr (intrinsic value) | MCROr (payoff) | Comment |

| 1 | 0.620 | 0.685 | 0.420 | (0.265) | EGP0.620/share is the price at which the right produces a negative payoff. |

| 2 | 0.885 | 0.685 | 0.685 | 0.000 | EGP0.885/share is the price at which the right produces a zero payoff (break-even). |

| 3 | 1.260 | 0.685 | 1.040 | 0.375 | EGP1.260/share is yesterday’s market price at which the right produces a positive payoff (i.e. the right is cheaper than the stock). |

Source: Rumble Research

What are the risks?

Currently, the right is trading at a discount to the stock, so in essence existing MCRO shareholders who are in the stock for the long term can make some money by selling their stock (sell high) then use that money to buy the right (buy low).

However, to benefit from this, they need to buy the right at the same time they are selling the stock, so that market fluctuation does not impact the final payoff.

The key risk is that MCRO’s stock price is currently trading at a huge premium (more than double) to the independent financial advisor’s (IFA) fair value post-capital increase of EGP0.62/share. Thus, those opting to hold on to MCRO shares after the rights are exercised face the market risk that MCRO stock price may fall in the future.

It is their decision then to either:

- Sell the stock once the subscription shares are made available in 2-3 months’ time, provided they are profitable.

- Continue to be long-term shareholders in the stock.

Investment Disclaimer

This document is for informational purposes only and should not be construed as a solicitation, offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or to provide any investment advice or service.

The information used to produce this market commentary is based on sources that Rumble Research (“Rumble”) believes to be reliable and accurate. This information has not been independently verified and may be condensed or incomplete. Rumble does not make any guarantee, representation, or warranty and accepts no responsibility or liability as to the accuracy and completeness of such information. Expression of opinion contained herein is based on certain assumptions and the use of specific financial techniques that reflect the personal opinions of the authors of the commentary and is subject to change without notice. It is acknowledged that different assumptions can always be made and that the particular technique(s) adopted, selected from a wide range of choices, can lead to a different conclusion. Therefore, all that is stated herein is of an indicative and informative nature, as forward-looking statements, projections, and fair values quoted may not be realized. Accordingly, Rumble does not take any responsibility for decisions made on the basis of the content of this commentary.

The decision to subscribe to or purchase securities in any offering should not be based on this report and must be based only on public information on such security.

Recommendations and general guidance are not personal recommendations for any particular investor or client and do not take into account the financial, investment, or other objectives or needs of, and may not be suitable for, any particular investor or client. Investors and clients should consider this only a single factor in making their investment decision, while taking into account the current market environment.

Neither Rumble nor any officer or employee of Rumble accepts liability for any direct, indirect, or consequential damages or losses arising from any use of this report or its contents.

Intellectual Property Rights: No part of this document may be reproduced without the written permission of Rumble. The information within this research report must not be disclosed to any other person if and until Rumble has made the information publicly available.