Egyptians love real estate — and for good reason. It’s familiar, trusted, and seen as one of the best ways to grow wealth over time. But what if you could invest in real estate without needing to buy a unit, wait for delivery, or manage tenants?

That’s what Bonyan for Development & Trade is offering.

The company is going public — and for the first time, you can invest in a business that owns income-generating commercial & administrative real estate like Walk of Cairo and gives you exposure to stable rental income, all through the stock market.And here’s the kicker: the IPO comes with a Stabilization Fund, which means your investment is protected if the price drops within the first 30 days after listing.

Why This IPO Is Different

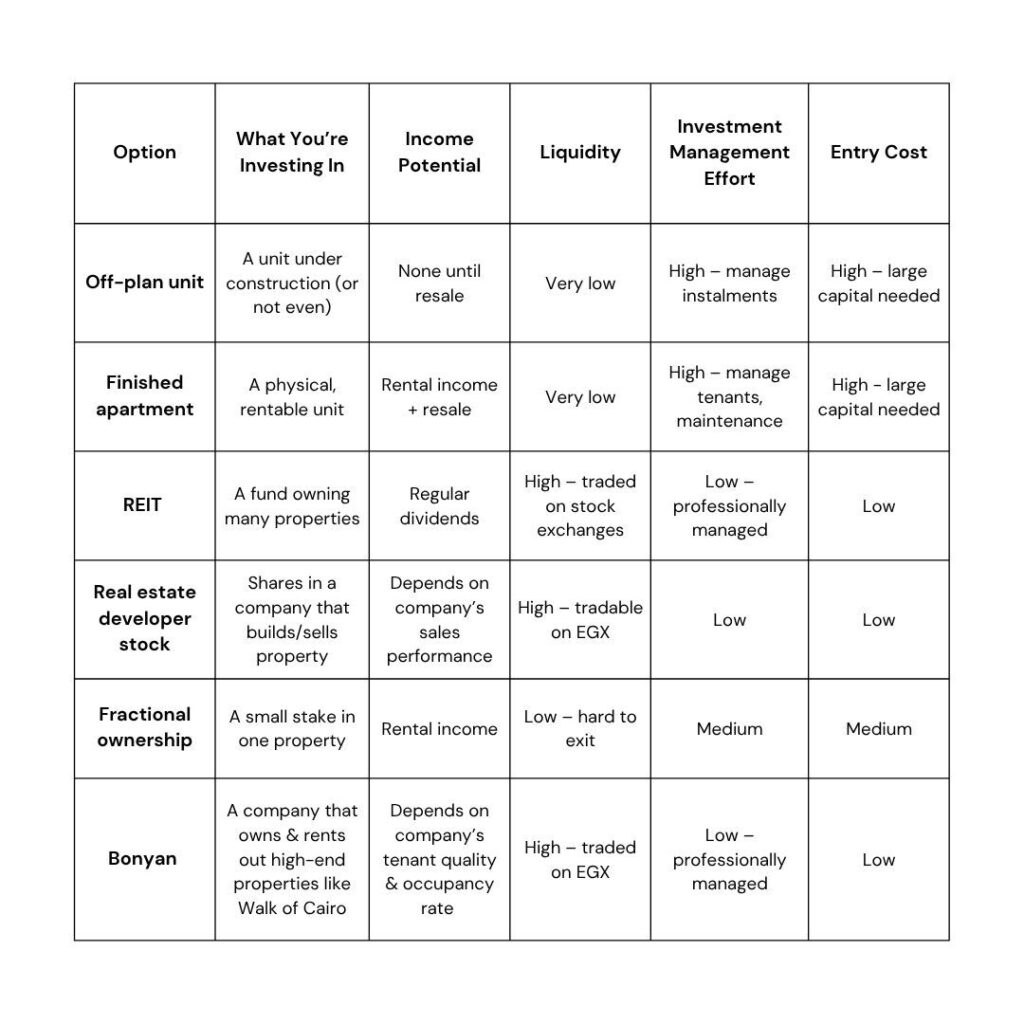

Not a developer. Not a fund.

This isn’t a company promising to build homes while looking to sell them off-plan. It’s not a real estate fund. It’s a cash-generating operation with tangible assets and steady rental income, and when you invest, you’re getting exposure to that income stream.

Established Revenue-Generating Assets

- 10 premium commercial properties in East & West Cairo

- 93% occupancy with 119 tenants

- Major brands include Nestlé, Turkish Airlines, Grohe, GE, Johnson & Johnson, Vodafone, and more

- 56% of leases are USD-priced — giving built-in inflation protection

- Rental income + capital appreciation

- Professionally managed by a seasoned team

- No construction risk — only completed, stabilized assets

Stabilization Fund = Risk-Free Entry

Just like past IPOs, this one includes a Stabilization Fund. Which means if the stock price drops during the first month of trading, you can get your money back.

How Bonyan Compares to Other Real Estate Investments

Recent IPOs Performance

Many of Egypt’s past IPOs has delivered impressive first-day returns:

-

- Fawry (FWRY) in 2019: +30% returns

- E-Finance (EFIH) in 2021: +50% returns

- ACT Financial (ACTF) in 2024: +29% returns

Even IPOs that started slow, like Macro Group (MCRO) in 2022 (down 35% after 30 days), were still a no-loss opportunity, since investors that wanted to, were able to recover their full investment using the stabilization fund.

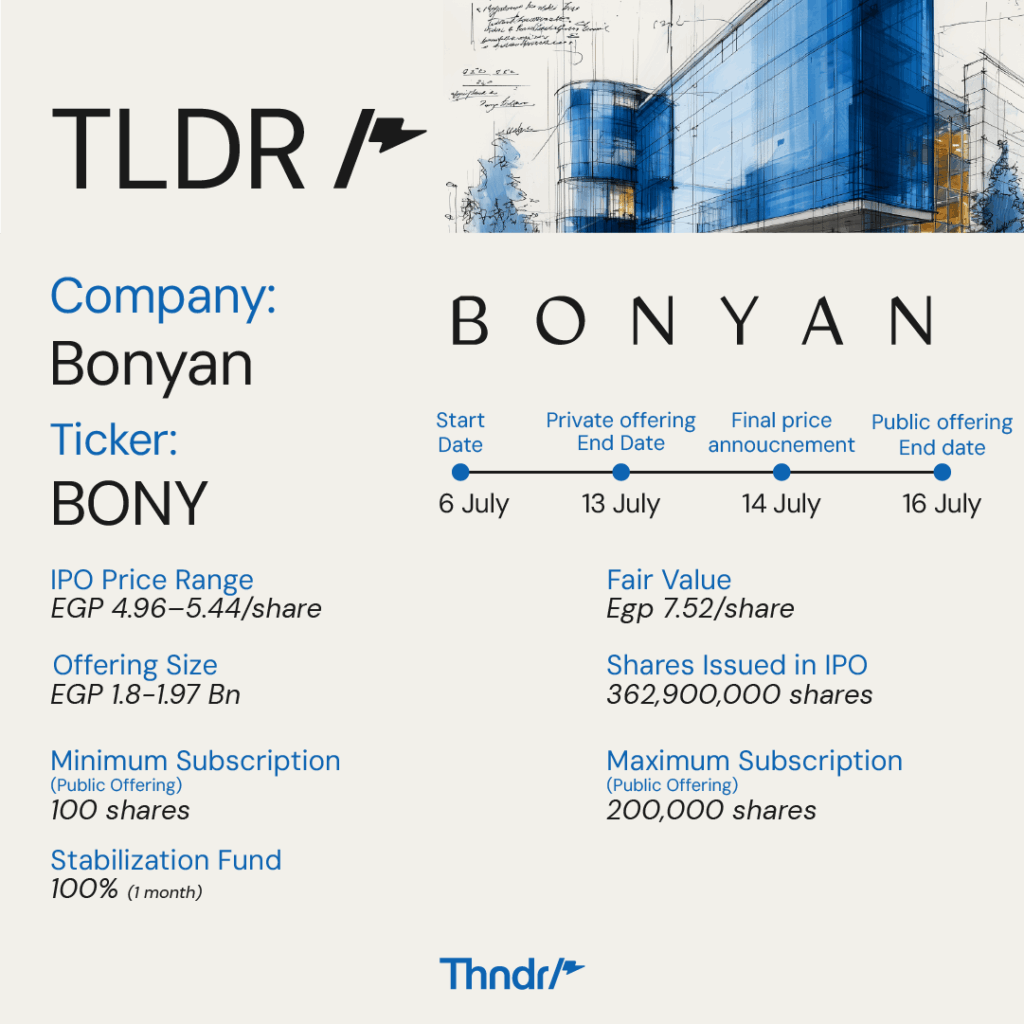

The TLDR of this IPO

If you want to go further in-depth on this IPO, you can read the prospectus issued by Bonyan here.

You can also review the valuation report issued by the Independent Financial Advisor (IFA) here.

How to invest in the Bonyan IPO

Follow these three simple steps:

-

- Download the Thndr app and open an investment account (if you haven’t already).

- Top up your wallet—make sure it’s ready before the subscription starts.

- Place your order directly on the app by searching for “BONY” and submitting your buy order.

If you’re a qualified investor interested in the private offering, check this article with all details

What experienced IPO investors already know and you should too:

Oversubscription Happens: IPOs are often oversubscribed, meaning you might get fewer shares than you wanted. Don’t worry—the unused money will be refunded to your Thndr wallet.

Maximize Allocation: Use Thndr’s feature to subscribe with up to 4x the money in your wallet to maximize your allocation, but be prepared to deposit the difference if the IPO is not oversubscribed (which is unlikely to happen).

Set a Reminder on day 30: If the stock price drops, remember to redeem your shares on day 30 to recover your investment. Thndr will send you reminders if this happens and all the required details.

Final Thoughts

This is real estate done differently: Fewer barriers. More access. Real income. And built-in protection.Whether you’re new to investing or looking to diversify beyond traditional assets, Bonyan’s IPO gives you a way in — without the usual stress of real estate.