A new investment product is now available on Thndr with the NBK Al-Mizan Balanced Fund. With a proven track record of growth and stability, Al-Mizan lets you invest in a mix of equities and fixed income — all from your Thndr app.

While Thndr already offers equity funds, money market funds, and gold, this is the first of its kind on Thndr — a fund that gives you both growth from equities and stability from fixed income in a single product.

Al-Mizan is an open-end balanced mutual fund managed by NBK Egypt Financial Investments, the investment arm of the National Bank of Kuwait in Egypt.

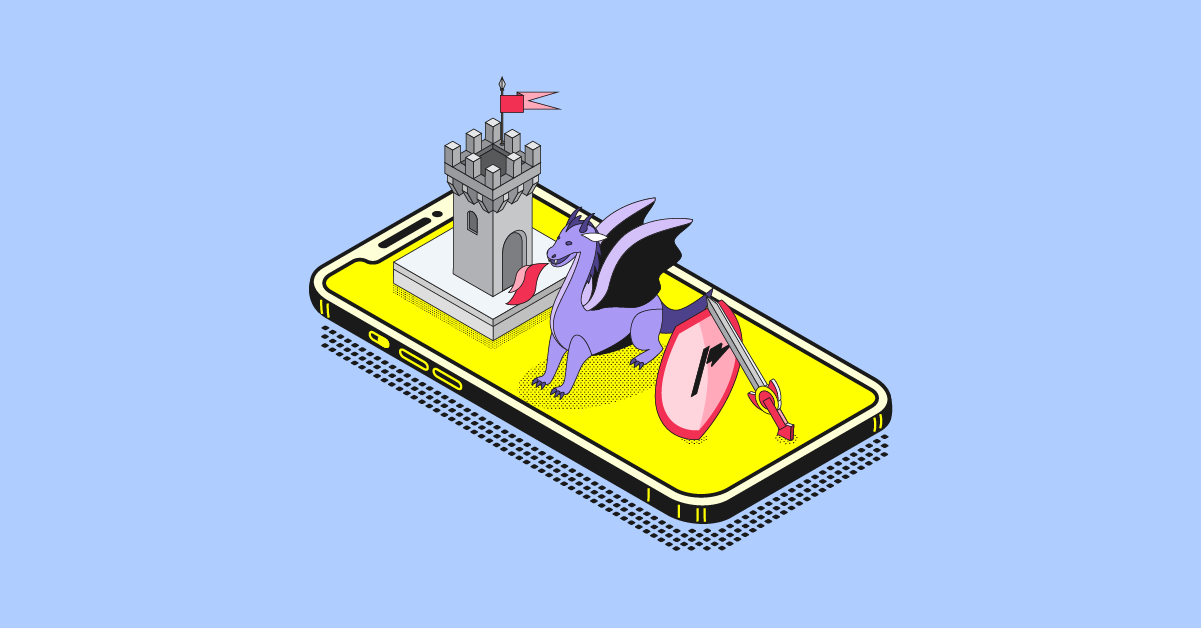

The fund follows a balanced investment strategy that combines the best of both worlds:

- Equities (stocks): Up to 60.78% of the fund, giving investors growth potential by investing in leading Egyptian companies — while ensuring no single company dominates the portfolio.

- Fixed income instruments (bonds, T-bills, deposits): Up to 39.23%% of the fund, providing stability and steady income.

Disclaimer: The figures presented are as of July 2025 and are subject to change.

By targeting roughly a 50/50 split between equities and fixed income, Al-Mizan allows investors to benefit from the stock market’s upside while cushioning risk with more stable debt instruments. All stats and figures mentioned are as of July 2025

Like all mutual funds, your money is pooled with thousands of others and professionally managed under a clear investment mandate — so you don’t need to worry about stock picking or timing the market yourself.

As of July 2025, the fund’s top 5 equity holdings were:

- Commercial International Bank (CIB): Egypt’s largest private sector bank, a leader in financial services and a benchmark for banking stability.

- GB Corp: One of the region’s biggest automotive players, covering passenger cars, commercial vehicles, and mobility solutions.

- Talat Moustafa Group (TMG) & Palm Hills : Two of the heavyweights in Egypt’s real estate development, behind landmark residential communities.

- ADIB – Egypt: :Abu Dhabi Islamic Bank -Egypt, is a leading universal bank that is fully Shari’a Compliant, focusing on service excellence, product and solution innovation.

This mix gives investors exposure to Egypt’s financial sector, real estate boom, industrial and consumer demand, all while balancing risk with fixed income assets.

Performance track record as of July 2025

Al-Mizan has consistently delivered strong results

| Year | % Return |

| 2024 Return (Dec 23 – Dec 24) | 37.87% |

| 3 year Return (Dec 2023–Dec 2024) | +112.38% |

| 5 Year Return (Dec 2019–Dec 2024) | +147.20% |

| Since Inception | +804.65% |

Why invest in Al-Mizan?

- Diversification across asset classes – With Al-Mizan, your money isn’t tied to just one type of investment. About half goes into equities (stocks), giving you exposure to Egypt’s leading companies like CIB, GB Corp, Palm Hills, and Juhayna, while the other half is allocated to fixed income instruments like bonds and treasury bills. This mix spreads risk — when stocks are volatile, bonds help provide stability, and when bonds are flat, equities can drive growth.

- Growth potential through equities – By investing in some of the largest companies on the Egyptian Exchange, Al-Mizan captures long-term growth opportunities. Equities have historically been one of the best ways to build wealth, and in 2024 alone, the fund delivered a +37.87% return. Over the past 5 years, the fund has grown +147.2%, and since inception, it has returned an impressive +804.65% — showing its ability to compound wealth over time.

- Income generation from fixed income – Unlike pure equity funds, Al-Mizan invests heavily in government and corporate debt instruments. These provide steady coupon payments or interest income. This income component makes it attractive for investors who want stability but also value regular payouts in Egyptian pounds.

- Reduced volatility compared to pure equity funds – Because not all of the fund is exposed to the stock market, sharp swings are cushioned by the stability of fixed income. For example, when equity markets slow down or face corrections, the fixed income allocation helps protect capital and smooth out returns. This makes Al-Mizan suitable for investors who want to grow their wealth but can’t tolerate the high volatility of a 100% equity portfolio.

- Low entry point – Al-Mizan allows you to invest with as little as EGP 9.3 (the nominal certificate value). You also don’t pay subscription or redemption fees, and orders can be placed weekly — giving you both low cost and flexibility to adjust your investments.

Here’s what you should be aware of:

- Market fluctuations: Stock prices and bond yields can move unpredictably, impacting fund performance.

- Interest rate risk: Rising interest rates can reduce the value of fixed income instruments.

- Equity exposure: While capped at 60%, equities can still experience sharp declines.

Like any investment, returns are not guaranteed — but Al-Mizan is designed to strike a balance between opportunity and safety.

Sounds like it’s for you? Here’s how you can invest in Al-Mizan on Thndr

You can find the NBK Al-Mizan Balanced Fund on Thndr by going to the Explore tab. Just search “Al Mizan” or “NBK” and you’ll find it easily.

When can I buy & sell Al-Mizan?

- Orders can be submitted until 1:00pm on the last working day of every week.

- Your request will be executed at that week’s closing price.

Example: If you place an order on Wednesday before 1:00pm, it will be processed at the end-of-week valuation.

What are the fees associated with this fund?

standard transaction fees apply on every buy and sell order.

More About NBK

The National Bank of Kuwait (NBK) is one of the largest and most reputable financial institutions in the region. Through NBK Egypt Financial Investments, they manage a range of funds across asset classes — with Al-Mizan being one of their flagship offerings.

Al-Mizan has also been recognized for its excellence:

- Best Performing Balanced Fund in MENA – MENA Fund Manager Awards (2015)

- Top Performer Balanced Fund Egypt – Zawya Fund Awards (2013)

Have any questions? Visit our FAQs or contact our support team through our in-app support or [email protected].