ADIB: What to do with the tradable rights?

Here is what you need to know about Abu Dhabi Islamic Bank – Egypt’s capital increase and what to do with its tradable rights.

19 November 2025

Amr Hussein Elalfy

In this note, we lay down the story behind Abu Dhabi Islamic Bank – Egypt’s [ADIB] EGP3bn capital increase and the different options available to you as an existing shareholder or as a prospective shareholder, whether you should sell your rights or exercise them. And here you are some dates to keep in mind:

- Rights trading: From 19 November through 1 December 2025, after which they will expire. Thus, you need to make up your mind during that period.

- Subscription to the capital increase: From 19 November through 4 December 2025 for those who are rights holders.

But let’s first remember what the stock exchange is important for.

A marketplace for everyone

The stock exchange is often looked at as an “exit market” when existing shareholders of companies sell their shares to new shareholders (investors) often at a premium to their original cost of acquisition. However, the stock exchange is not only a marketplace where sellers can dispose of their shares. In fact, the most important role of a stock exchange is for companies to raise required capital from existing shareholders or investors at large to support their growth.

Thus, the stock exchange is indeed a marketplace for everyone: a marketplace for “existing” shareholders to raise liquidity by selling their “existing” shares and a marketplace for companies to raise capital by selling “new” shares to “new” investors.

Two examples

Let’s take two quick examples.

If a privately-held company wants to raise capital, it can do so through an initial public offering (IPO) by issuing new shares to investors (potential new shareholders). This is known as a primary offering, similar to what Bonyan for Development & Trade [BONY] did in its IPO when it raised EGP250mn as part of the IPO process.

On the other hand, if a listed company wants to raise capital, it can do so by calling on its existing shareholders to shore up new capital to fund their operations and/or reduce debt, for example. This is what Abu Dhabi Islamic Bank Egypt [ADIB] is doing today.

What about ADIB’s tradable rights?

What happened?

ADIB is currently undergoing an EGP3bn capital increase by issuing 300mn shares at a par value of EGP10 a share in addition to EGP0.10 a share as issuance fees. All in all, the bank will potentially raise a total of EGP3.03bn at the end of the day if the capital increase is fully covered. Thus, ADIB will be raising its paid-in capital from a current EGP12bn (1.2bn shares at a par value of EGP10/share) to EGP15bn (1.5bn shares at a par value of EGP10/share).

Know your options: Who gets what?

Each group of investors (existing or new ADIB shareholders) will have several options to consider.

Existing shareholders

This capital increase was available for ADIB’s existing shareholders at the end of 16 November 2025 at a ratio of 1-to-4 (300mn “new” shares for 1.2bn “existing” shares). This means if you were a shareholder as of that date and say you owned 100 shares, today you would have the same 100 shares plus 25 rights that you can use to subscribe to 25 new shares.

Available options

These existing shareholders have two options:

- Exercise the right to subscribe to the capital increase, especially if you think ADIB’s stock is undervalued and you believe in the long-term value of the bank’s franchise.

- Sell the right for any particular reason, such as:

- You do not have enough cash to shore up for the capital increase.

- You want to raise liquidity by partially exiting your investment in ADIB.

- You think ADIB’s stock is overvalued.

Investors (new shareholders)

An ADIB existing shareholder who decides to forgo the opportunity to participate in the bank’s capital increase can sell the rights in the market, where either other existing ADIB shareholders or investors who are non-shareholders would buy them.

Available options

These investors have two options:

- Exercise the right to subscribe to the capital increase, assuming they think ADIB’s stock is undervalued and they believe in the long-term value of the bank’s franchise.

- Sell the right if its market price rises beyond their acquisition cost so that they can generate a positive return.

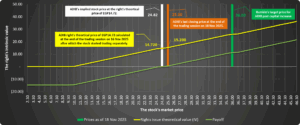

All options in charts

To make things even more crystal clear, we need to consider the rights as a call option that grows in value as the underlying stock (ADIB in this case) grows in value.

Source: Rumble Research

Key price levels to keep in mind

| EGP/share (EGP/right) | ADIB (stock) | ADIBr (right) | Subscription price |

| ADIB’s stock price adjusted for the rights (16 Nov 2025) | 24.82 | 14.72 | 10.10 |

| ADIB’s stock price (18 Nov 2025) | 25.30 | 15.20 | 10.10 |

| ADIB’s target price (Rumble) | 36.00 | 25.90 | 10.10 |

Source: Rumble Research

Now what?

Given that ADIB is an open fundamental recommendation that we have, we believe the stock is undervalued. Our latest target price based on a 1.2bn share count was EGP42.5 a share. This is a pre-capital increase valuation. Assuming the capital increase is fully covered, which we think it will be, then the post-capital increase target price is now EGP36 a share, implying a 42% upside from the latest closing price of EGP25.30 a share.

Recommended actions

We maintain our INVEST rating on ADIB, which also means we recommend for existing shareholders to subscribe to the capital increase. This is in view of its above-average growth rate and potential windfall from its upcoming capital increase. We believe the capital increase will help grow the bank’s balance sheet and eventually drive growth and profitability higher further.

Meanwhile, keep the following in mind:

| If the price of ADIB’s | is | The price of ADIB’s | then |

| For ADIB existing shareholders | |||

| right + 10.10 | lower than | stock | Buy the right then subscribe |

| right + 10.10 | higher than | stock | Sell the right and buy the stock |

| For other investors | |||

| right + 10.10 | lower than | stock | Buy the right then subscribe |

| right in the market | higher than | right (at acquisition) | Either sell the right at a profit or keep it to subscribe |

| right in the market | lower than | right (at acquisition) | Keep the right then subscribe |

Note: In any case, if the market price of the right rises higher than the price at which you acquired it, you can sell it in the market at a profit.

Source: Rumble Research

Investment Disclaimer

This document is for informational purposes only and should not be construed as a solicitation, offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or to provide any investment advice or service.

The information used to produce this market commentary is based on sources that Rumble Research (“Rumble”) believes to be reliable and accurate. This information has not been independently verified and may be condensed or incomplete. Rumble does not make any guarantee, representation, or warranty and accepts no responsibility or liability as to the accuracy and completeness of such information. Expression of opinion contained herein is based on certain assumptions and the use of specific financial techniques that reflect the personal opinions of the authors of the commentary and is subject to change without notice. It is acknowledged that different assumptions can always be made and that the particular technique(s) adopted, selected from a wide range of choices, can lead to a different conclusion. Therefore, all that is stated herein is of an indicative and informative nature, as forward-looking statements, projections, and fair values quoted may not be realized. Accordingly, Rumble does not take any responsibility for decisions made on the basis of the content of this commentary.

The decision to subscribe to or purchase securities in any offering should not be based on this report and must be based only on public information on such security.

Recommendations and general guidance are not personal recommendations for any particular investor or client and do not take into account the financial, investment, or other objectives or needs of, and may not be suitable for, any particular investor or client. Investors and clients should consider this only a single factor in making their investment decision, while taking into account the current market environment.

Neither Rumble nor any officer or employee of Rumble accepts liability for any direct, indirect, or consequential damages or losses arising from any use of this report or its contents.

Intellectual Property Rights: No part of this document may be reproduced without the written permission of Rumble. The information within this research report must not be disclosed to any other person if and until Rumble has made the information publicly available.