Watch instead: A must-watch conversation with CEO Ahmad Hammouda and Amr El Alfy breakdown the GOUR IPO!

This is all you need to know about Egypt’s first IPO in 2026: The country’s leading premium grocer.

30 January 2026

Amr Hussein Elalfy*

The Story

Gourmet [GOUR] is one of Egypt’s most established food retailers, built around a simple idea: offering high-quality food to customers who care about what they consume. What began as a family-run business has grown steadily over time into a trusted brand, with a loyal customer base and a clear focus on quality rather than rapid, unfocused expansion.

The company serves a specific segment of consumers whose spending tends to remain more stable even during economic slowdowns. This positioning has helped Gourmet maintain resilience compared to more mass-market retailers that are more exposed to swings in consumer purchasing power.

A key part of Gourmet’s model is that it produces a meaningful portion of what it sells through its own food solutions arm. This gives the business greater control over quality, costs, and supply, while reducing exposure to imports. In a market where currency and supply-chain disruptions can be common, this level of control has become an important advantage.

Over the past two years, Gourmet has gone through a clear operational turnaround. After a period of losses, the company returned to profitability in 2024 and has continued to build on that momentum. Strong cash generation has allowed Gourmet to fund store expansion, invest in the business, and pay dividends without relying heavily on debt.

Looking ahead, Gourmet’s growth plans are focused and disciplined. The company intends to expand its store network in key areas such as East and West Cairo, operate larger and more efficient formats, and grow its in-house and private-label offerings. At the same time, loyalty programs and better use of customer data are expected to deepen engagement with existing customers.

With this IPO, Gourmet becomes the first food retailer to list on the main Egyptian Exchange. For investors, this provides differentiated exposure to Egypt’s consumer sector through a business with a strong brand, controlled growth, and a long-term mindset.

As with any investment, risks remain – including competition and the niche nature of the segment Gourmet operates in. That said, the company’s brand strength, control over its products, and consistent cash generation give it a solid foundation as it enters the public market.

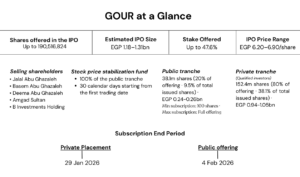

The IPO

GOUR will go public on the main exchange through a public and private offering with the following details:

Source: Prospectus, Rumble Research

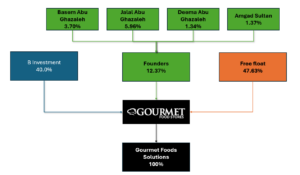

Shareholder Structure (Pre-IPO)

Source: Prospectus, Rumble Research

Shareholder Structure (Post-IPO)

Source: Prospectus, Rumble Research

Background

2006: A Premium Retail Brand Was Born

- GOUR was established in 2006, initially supplying high-end hotels and business clients in Cairo with quality meat and specialty food products. This early success led the company to open its first premium retail store in 2008, offering a curated selection of fresh, locally produced, and imported goods not commonly found in traditional supermarkets. Since then, GOUR has continued to grow while focusing on quality, reliability, and customer experience.

2015: Vertical Integration Strategy Adopted

- In early 2015, rising devaluation pressures on the EGP forced GOUR to pivot from importing and distributing final products to outsourcing and manufacturing. This shift introduced Gourmet Foods Solutions (GFS) to the market, a “Handcrafted by Gourmet” production line operating in two factories (kitchens), one owned and another leased.

2018: B Investments Steps In

- In 2018, EGX-listed B Investments Holding [BINV] acquired a significant stake in GOUR (40% initially) before increasing it through a follow-on capital increase (to 52.9%). This step reflected BINV’s confidence in GOUR’s business and its potential to grow as a leading premium food retailer in Egypt.

2020: The Up Spike

- Like basically all other businesses, GOUR’s nationwide expansion was disrupted by COVID-19 in 2020 which slowed momentum at first in its walk-in stores due to nationwide lockdown. However, the silver lining was for GOUR’s business to go online. Indeed, GOUR launched its digital app to cater to its clientele who preferred online shopping to in-store shopping. Also, the new app helped GOUR capture customer data and refine offerings personalization for customers.

- To capture growing demand, GOUR invested heavily in acquiring three delivery hubs around Greater Cairo to be closer to its customers. But after lockdown restrictions were lifted, customers began going back to in-store shopping. Thus, overspending resulted in losses in 2021 and 2022, having expanded aggressively in the delivery segment with revenues not picking up as fast as expected.

2022: The Turnaround

- GOUR’s shareholders, led by BINV, decided it was time to turnaround the business. In 2022, GOUR hired a veteran team led by Michael Wright with vast regional retail experience in the MENA region across many household names.

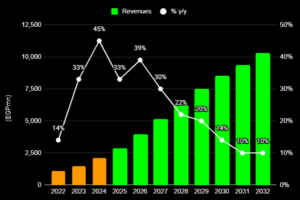

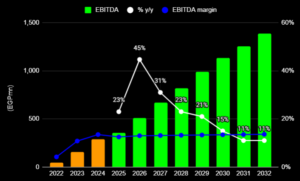

- Under the new management team’s oversight, revenue maximization and cost reduction measures helped restore profitability, delivering net profits of EGP31mn in 2023 and EGP135mn in 2024, with more than EGP200mn estimated in 2025. This turnaround story was driven mostly by organic growth with zero net additional stores in 2024 and 2025.

2026 & Beyond: The Next Chapter

- GOUR’s vision is to continue growing and unlocking additional value within its existing business. This will be done through two pillars:

- An organic pillar through increasing the retail area of existing locations to improve customer experience and support higher basket sizes and better traffic flow, while maintaining its premium positioning.

- Expanding its presence across East and West Cairo, while remaining open to selective opportunities in Downtown Cairo if attractive locations become available.

How GOUR Makes Money

Premium retailing, in-house products & e-commerce

- Premium Retailing

GOUR targets niche, higher-spending customers rather than competing with mass-market retailers, which limits direct competition. The company also operates three seasonal stores in the North Coast, supporting its geographic diversification and exposure to premium consumer demand. - In-house Products

Gourmet Food Solutions (GFS), a wholly owned subsidiary of GOUR, is its in-house food production and processing unit. GFS cuts the middle-man by making fresh and ready-to-eat products like sandwiches, bakery items, ready-to-eat meals, and salads. GFS provides its products to Gourmet’s stores, Gourmet’s online platform, and selected business clients. Regular retail products usually have a 20-30% gross margin, while Gourmet’s in-house and private label products have a higher margin of about 50% because they are exclusive and premium. - E-Commerce

GOUR’s e-commerce channel sells products directly to its customers on its website and mobile app. This online channel helps GOUR reach more customers who can make more orders from the comfort of their home, while GOUR uses the customer data to improve its product offerings. Today, e-commerce and call centers contribute about 35% of GOUR’s total sales with room to grow further.

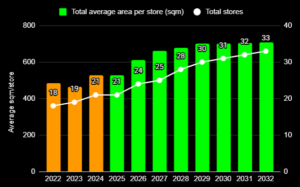

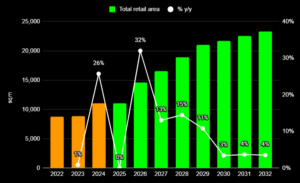

GOUR in Charts

Source: B Investments Holding Earnings release, Rumble Research

Source: B Investments Holding Earnings release, Rumble Research

Source: B Investments Holding Earnings release, Rumble Research

Source: B Investments Holding Earnings release, Rumble Research

The Good

- First of its kind on the EGX

- Gourmet’s IPO marks the first time for the EGX to see a retailer in the F&B industry listed on the main exchange. For investors with an appetite for the retail business, their only available option is GOUR, especially given its much better margins versus regional peers.

- Operating in a segment with relatively inelastic demand

- GOUR operates within a niche market, targeting the affluent segment of the society. This helps smooth out any earnings volatility in the case consumer purchasing power softens. So, while some consumers may decide to shift from premium products toward more affordable alternatives, GOUR’s clientele is loyal in view of its premium-quality products and minimal impact on their spending habits despite any economic downturn.

- Asset-light, lease-based business model

- GOUR’s lease-led expansion strategy lowers upfront capital requirements per store, supporting an average rollout of 2–3 stores annually. The company targets store sizes of at least 800 sqm. Fit-out costs average EGP60–80mn per 1,000 sqm (implying a cost of EGP60-80k per sqm).

- However, in mall locations, GOUR typically bears around half of that cost, with landlords funding the rest. This is because GOUR has become a partner of choice for many real estate developers. This allows GOUR to expand more rapidly and achieve attractive returns for new stores.

- For instance, the last 2 stores GOUR opened had a payback period of 1 year.GOUR’s lease tenors average nine years which enhances cash flow visibility. Leases entered into with real estate developers usually have both fixed and variable components. The fixed component is a minimum guarantee lease payment, which is fairly easily surpassed by the variable component (a revenue share model).

- Vertical integration driving margin resilience

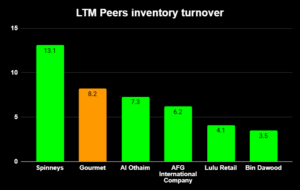

- Logistics & supply chain risk management: Given that GFS primarily serves GOUR, the company maintains tight control over inventory levels, reducing reliance on external suppliers. This vertical integration has supported higher inventory turnover ratio relative to peers.

- Limiting imports: GOUR’s transition toward local manufacturing reduced FX-related cost pressure while preserving its premium positioning, boding well for margins.

- Outsourcing equipment: For products requiring specialized, capital-intensive equipment, GOUR outsources production through rented manufacturing lines at third-party facilities. This strategy supports higher profitability while hedging against changes in consumer demand.

Source: Koyfin, Rumble Research

- Sustainable cash flows with high earnings visibility

- Short payback period: GOUR’s new stores benefit from a short payback period, typically recovering their investment in less than one year. This demonstrates how the company uses its capital efficiently and ensures that new stores will be cash flow positive quickly. This highlights the resilience and attractiveness of GOUR’s business model.

- Short cash conversion cycle: GOUR operates with a negative cash conversion cycle (CCC) of around 2 days. With more than 50% of sales paid using credit cards, GOUR receives cash from customers before supplier payments are due. This enables the company to fund expansions internally without having to resort to a high level of leverage while also paying cash dividends.

- Experienced management and an active institutional shareholder

- GOUR’s new management team has turned two years of losses into a profitable business. The management team behind this turnaround story, led by Micheal Wright, comes from a regional retail background with a strong track record in many household names, including Bin Dawood in Saudi Arabia and Spinneys in the UAE, Qatar, Egypt, and Lebanon.

- The management team brought onboard by BINV is contracted to remain with GOUR through 2027. However, there is a 5-year ESOP program (expected to be around 5% of GOUR’s shares) that will help retain the management team and other key members within GOUR through 2030.

Key Risks

- Limited and niche market segment

- GOUR’s market share remains limited within Egypt. With projected 2025 revenues near the EGP3bn mark, GOUR’s market share in Egypt’s F&B segment could be well below 5%. GOUR’s total available market (TAM) is constrained by its premium business model targeting quality-conscious consumers, limiting its audience to those with higher purchasing power.

- Limited access to digital retail channels

- Lately we have seen logistics companies offer groceries through their digital channels, like Talabat and Instashop. These companies would definitely expand GOUR’s reach, yet they only contribute around 5% of revenues–a strategic decision by GOUR to safeguard its profitability margins.

- On the other hand, online competition is intensifying. For instance, Breadfast, Egypt’s largest digital food and beverage retailer, could represent a key online competitor to GOUR. Breadfast operates through a fully-digital model, with no physical retail stores, selling exclusively through its mobile application and supported by its own network of delivery hubs.

- Similar to GOUR, Breadfast has developed product lines under the “Made by Breadfast” brand, while also selling white-label products for third parties for higher margins, a model GOUR does not follow. Both companies rely on owned delivery infrastructure to control quality and fulfillment.

- A limited number of SKUs

- The average stock keeping unit (SKU) for the retail businesses in Egypt is usually between 50,000-60,000 SKUs. GOUR has an estimated total of 11,000 SKUs, with 1,200-1,500 SKUs exclusive private labels made by Gourmet.

- This is a key risk because a limited product range deprives customers from variety which can lower the value of each shopping basket.

- Indirect FX exposure but manageable

- GOUR does not have direct exposure to FX as it imports its products from local suppliers. However, GOUR is somehow exposed to a stronger FX rate which could make its imported products more expensive for certain customers. This is quite important absent any FX inflows.

- However, the fact that GOUR operates in a niche market segment that is less vulnerable to a weaker local currency helps mitigate such risk.

- Also, GOUR’s product positioning allows it to pass on higher costs to consumers, though this may weigh on volumes.

Investment Catalysts

- Active shareholder with clear value-creation agenda

- BINV, the company’s major shareholder, still sees untapped potential growth for GOUR. Indeed, BINV expects GOUR’s revenues to double in the next three years, further expanding its market share.

- This is evidenced by BINV’s strategic decision to only undertake a partial exit on only a quarter of its holding (13% of its 53% stake). This should assure new GOUR investors that at some point of time in the future BINV will be looking to monetize its remaining 40% stake at a higher valuation level.

- In other words, BINV is GOUR’s active investor looking to maximize shareholders’ value.

- Successful execution of store expansion plan

- More stores down the aisle: GOUR’s expansions will mainly be in East and West Cairo, currently preparing two stores (potentially three stores) for 2026.

- The G17 store is destined to start operations after Ramadan, while the Midlane is expected to start operations after summer between September and October 2026.

- These new stores will attract more consumers, driving revenue growth further and hence profitability driving growth.

- Bigger space stores: While it was the management’s strategy to increase the number of stores, it’s also their plan to increase their sizes. Having bigger stores allows GOUR to have its kitchen/bakery in the same location, thus minimizing costs. Also, in big stores they have opportunities to innovate and increase their services.

- This aligns with GOUR’s strategy to maintain its geographic footprint as they plan to replace small size stores with larger ones of at least 800 sqm at the same locations.

- Anchoring customers through loyalty programs

- Loyalty programs: GOUR’s loyalty program helps the company build stronger relationships with customers by encouraging repeat purchases and higher visit frequency. It also allows GOUR to collect valuable data on shopping behavior, which can be used to improve product selection, pricing, and promotions.

- Over time, this supports more stable revenue, better inventory planning, and more efficient marketing spend.

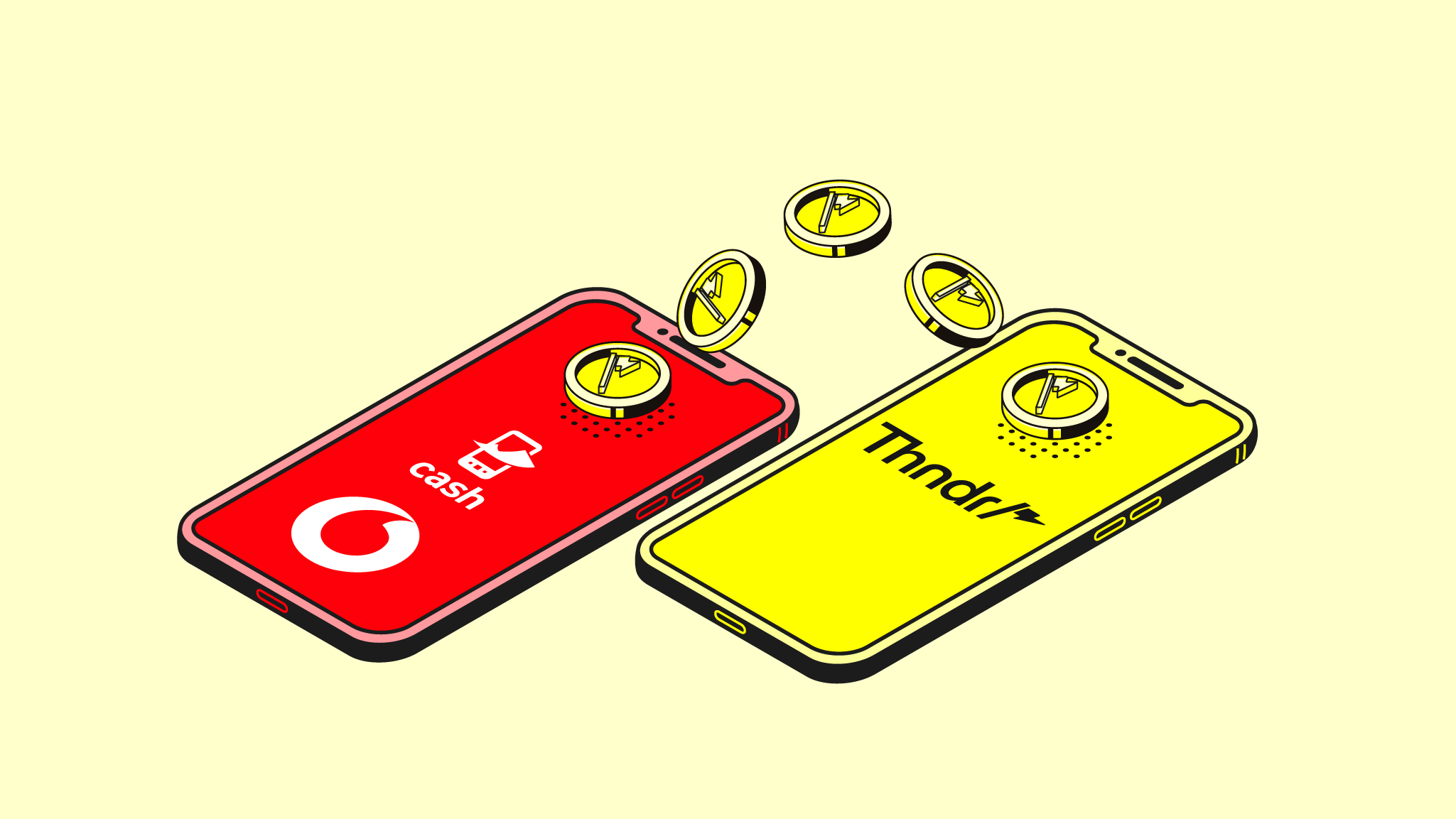

Mobile network partnerships: GOUR’s partnership with Orange has been positive, increasing sales without any expenses. Orange provided its Premier clients discounts at GOUR stores through their collaboration. - This brings more customers without increasing selling and marketing expenses.

- Consistent cash dividend payout down the road

- Unlike a few years ago, GOUR’s business model displays today high cash flow visibility. This could mean there will be potential dividends payouts. GOUR’s management intends to pay out dividends in the range of 50-75% of net income.

- An acquisition target by financial or strategic investors

- With BINV retaining a 40% stake in GOUR, this opens the door for potential M&A deals involving GOUR. BINV will be looking to exit GOUR at one point of time in the future, and ideally they will be doing so at a valuation higher than the IPO price, which would act as a floor, in our opinion. This will help the stock re-rate higher after listing.

* Helped in writing this article: Abdelkhalek Mohamed, Equity Strategist and Karim El-Ghazaly, Equity Strategist.