Tawasoa Factoring [TWSA]: Helping SMEs unlock their potential

This is all you need to know about TWSA’s IPO.

Amr Hussein Elalfy

30 October 2025

The Story

A nascent industry with room for exponential growth

Factoring in Egypt is a relatively nascent industry. It began only 18 years ago when Egypt Factors, initially backed by Commercial International Bank [COMI], became the first licensed factoring company in the country and remained so for the following 4.5 years. Today, there are 37 factoring companies licensed in Egypt with a total portfolio size of EGP43.7bn at the end of 30 June 2025, only 0.3% of Egypt’s GDP. This compares to around 5% of GDP in emerging markets. This potentially implies that Egypt’s factoring industry has room to grow 15x its current size.

TWSA helps SMEs manage their working capital needs …

In July 2020, Tawasoa Factoring [TWSA] acquired its license, led by a group of entrepreneurs whose goal was to create Egypt’s first non-banking financial institution fully dedicated to factoring. Capitalizing on the expertise and diverse professional backgrounds of its founders, TWSA’s aim is to bridge the gap in the Egyptian market, helping small- and medium-sized businesses unlock the power of their receivables. TWSA offers premium, fast, and tailor-made factoring solutions, thus supporting its clients in managing their working capital needs to ensure continued growth, enhance cash flows, and drive expansion.

… with portfolio size set to double by 2026 …

With a portfolio size of EGP111mn at the end of 30 June 2025, TWSA’s market share stood at only 0.3% of the factoring industry in Egypt. The company’s plan is to more than double its portfolio to EGP260mn by the end of 2026.

… hence, the need to grow its capital

TWSA’s paid-in capital has been on the rise since its establishment. It grew 5 fold from EGP15mn at the end of 2021 to EGP75mn currently. To further drive its next chapter of growth, TWSA has made the strategic decision to list on the SME Exchange (previously known as Nilex). It plans to later call for an EGP40mn capital increase to grow its equity capital 1.5x to EGP115mn within the next couple of months.

The IPO

- TWSA will go public on the SME Exchange through a public and private offering with the following details:

| Number of shares offered in the IPO | 18,750,000 |

| Estimated stake | 25% |

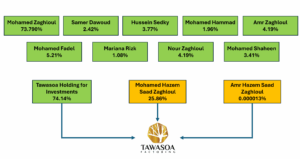

| Selling shareholder | Mohamed Hazem Saad Zaghloul Mohamed

|

| IPO price | EGP1.73 a share |

| Estimated IPO size | EGP32.4mn |

| Subscription period | Sunday, 2 Nov – Thursday 6 Nov 2025 |

| Private tranche

(Qualified investors only) |

|

| Public tranche |

|

| Stock price stabilization fund |

|

Source: EGX, Company prospectus.

The Capital Increase

- According to TWSA’s prospectus, within 60 days following the end of the stock price stabilization fund, TWSA plans to undergo a capital increase of EGP40mn (40mn new shares at a par value of EGP1/share).

- All existing shareholders (including those who subscribed in the IPO) will be eligible to subscribe to the capital increase.

What is Factoring?

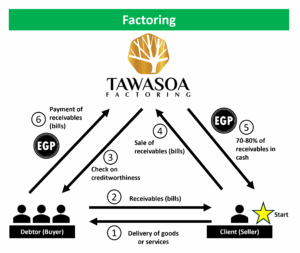

Factoring is a financial service that helps businesses turn their invoices into immediate cash. Instead of waiting for customers to pay, a business can sell its accounts receivable to a third party, called a factor, at a discount. This gives the business quick access to funds, helping it manage its expenses and maintain steady cash flows. Factoring is especially useful for SMEs that face long payment cycles or need quick financing to support their operations and growth.

How Factoring Works

Factoring transforms unpaid invoices into a source of immediate liquidity, turning waiting time into working capital as follows:

- The Client (Seller) starts by selling its unpaid invoices to the factor.

- In return, the Factor instantly provides around 70–80% of the invoice value, giving the business access to cash within days instead of months.

- When the Debtor (Buyer) settles the invoice, the factor releases the remaining balance to the business after deducting a small fee, thus netting a profit.

This process allows companies to focus on growth and operations rather than chasing payments or facing cash shortages. In essence, factoring converts potential into power, enabling businesses to move forward without financial delays.

Parties Involved

- Client (Seller): The business that sells its invoices to receive instant cash.

- Factor (Tawasoa Factoring): The financial institution that purchases the receivables and provides the funding.

- Debtor (Buyer): The customer that owes payment on the invoice.

Source: Rumble Research

Key Advantages

- Immediate cash flow: Converts unpaid invoices/bills into instant funding to cover expenses or support growth.

- No debt incurred: Provides financing through the sale of receivables rather than borrowing.

- Flexible and scalable: Funding grows in line with sales and receivables.

- Simplified collections: The factor manages customer payments, saving time and effort.

- Risk reduction: Factors assess customer creditworthiness, lowering exposure to bad debts.

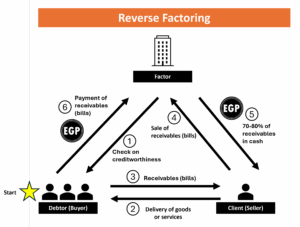

What is Reverse Factoring?

Note: TWSA does not currently offer reverse factoring, but it plans to do so in the future.

Reverse factoring, also known as supply chain financing, is a financial solution designed to support both buyers and their suppliers. Unlike traditional factoring, where the supplier (seller) initiates the transaction, reverse factoring is typically arranged by the debtor (buyer) to help suppliers receive early payment on their invoices.

In this arrangement, a financial institution (the factor) pays the supplier (seller) on behalf of the debtor (buyer) before the invoice’s due date. The buyer then repays the factor at a later, agreed-upon date. This process improves the supplier’s cash flow while allowing the buyer to maintain longer payment terms — creating a mutually-beneficial relationship across the supply chain.

How Reverse Factoring Works

- The supplier delivers goods or services and issues an invoice to the buyer.

- The buyer confirms the invoice and approves it for payment.

- The factor pays the supplier early, typically covering 100% of the invoice amount minus a small fee.

- On the agreed due date, the buyer repays the factor in full.

This process creates a win–win dynamic: suppliers receive immediate liquidity and reduce financial pressure, while buyers strengthen their supply chains and may even negotiate better terms with suppliers.

Parties Involved

- Debtor (Buyer): The company purchasing goods or services and initiating the financing arrangement.

- Client (Seller): The company providing goods or services and receiving early payment.

- Factor (Financial Institution): The intermediary that pays the supplier and later collects payment from the buyer.

Source: Rumble Research

Key Advantages

- For Sellers (Suppliers): Provides faster access to cash and lowers the risk of delayed payments.

- For Buyers: Helps maintain stronger supplier relationships and ensures stability in the supply chain.

- For Both: Enhances operational efficiency and reduces financing costs through collaboration.

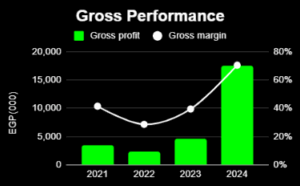

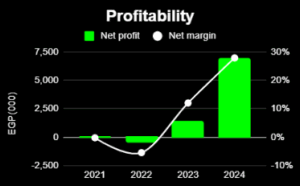

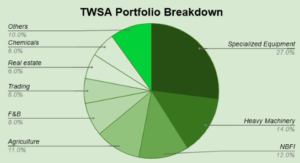

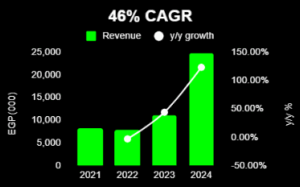

TWSA in Charts

Source: Company reports.

IFA Valuation

TWSA’s fair value was set by the independent financial advisor (IFA) at EGP1.73 a share, valuing the company at around EGP130mn (based on a 75mn share count). To reach its fair value, the IFA used two valuation methods:

- Residual income model (70% weight): The model basically considers the residual income generated by the company (i.e. the economic profit in excess of the company’s equity capital charge), projects a terminal growth rate, then discounts all to the present value to add to the company’s existing book value of equity. This approach yielded a fair value of around EGP135mn or EGP1.80/share, net of a 5% discount for the lack of control given the relatively small size of the stake offered.

- Price-to-book multiple (30% weight): This method looked at a list of comparable companies trading on the EGX within the financial sector (which included listed banks), reaching an average P/BV of 1.45x. This approach yielded a fair value of around EGP117mn or EGP1.56/share.

The Bottom Line

When it comes to investing in a non-banking financial services (NBFS) firm, what really matters is its profitability relative to its capital base. As for TWSA, it is going in the right direction, growing its portfolio and profitability. However, TWSA needs to reach its critical mass in terms of equity capital to unlock its growth potential, which it hopes to do with its proposed capital increase following its listing. On one hand, being a small-cap stock trading on the SME Exchange may limit the number of investors who will be willing to take on the risk of a company of this size. On the other hand, if TWSA manages to grow its capital base then graduate to the main market, this could be a catalyst for its stock performance.

For a more detailed view on TWSA’s valuation and what to do with the stock, you can subscribe to Rumble.

Follow these three simple steps:

-

- Download the Thndr app and open an investment account (if you haven’t already).

- Top up your wallet—make sure it’s ready before the subscription starts.

- Place your order directly on the app by searching for “TWSA” and submitting your buy order.