Why MTOs are not mandatory to everyone. Investors have the option to either sell their shares or hold on to them.

2 October 2025

Amr Hussein Elalfy

Background

- On 31 July 2025, Raya Customer Experience [RACC] disclosed that its parent company Raya Holding for Financial Investments [RAYA] formally notified the Financial Regulatory Authority (FRA) of its intention to launch a mandatory tender offer (MTO) to acquire up to 90% of RACC’s capital at an initial price range between EGP6.87 and EGP7.5 per share.

What happened?

- Almost two months later on 28 September 2025, RACC received the FRA approval to publish the MTO, with the following details:

- RAYA is offering to acquire up to 43,952,433 shares of RACC, equivalent to 22.1% of RACC’s issued shares net of 5,916,785 treasury shares that are more than one year old (i.e. 199,206,202 shares, which is 205,122,987 issued shares less the 5,916,785 treasury shares).

- The final MTO price is set at EGP7.50 per share, the maximum of the initial price range.

- The MTO runs for 20 working days from 28 September through 26 October 2025.

- Execution of the MTO will be within 5 working days after the end of the MTO (i.e. by maximum 2 November, according to our calculation).

- RAYA’s goal is to raise its ownership in RACC up to 90% from its current 59.9%.

- RAYA does not have any intention to merge RACC into any other entity for the time being.

What is an MTO and why do it?

- According to the Executive Regulations of the Capital Market Law No. 95/1992 (Chapter VI, Article No. 353), when an investor wants to acquire a certain stake in a target company either independently or through related entities, it has to submit what is known as a mandatory tender offer or MTO to acquire up to 100% of the target company. Such MTO is triggered when the targeted stake is either 33.3%, 50%, 67.7%, or 75% of the target company or more.

- MTOs are one of the tools that the FRA uses to protect the interest of minority shareholders in a company listed on the Egyptian Exchange (EGX). Through the MTO, minority shareholders are given the opportunity to accept the offer being made for the target company’s shares at the announced offer price.

- However, if the acquirer intends to keep the target company listed on the EGX, the MTO will be for the maximum number of shares that the acquirer can buy while keeping the required minimum number of shares for the target company to remain listed on the EGX.

- According to the EGX Listing and Delisting Rules (Section II, Article No. 7), to remain listed on the EGX, a company has to meet the minimum allowed percentage to remain listed on the EGX, its free float shares must not be less than (a) 10% of its listed shares or (b) 0.0125% of the EGX’s free-float market cap, provided that it does not fall below a minimum of 5% of its listed shares.

What choices do I have?

- If you are a shareholder in RACC, you have the choice to do one of two things:

- Accept the MTO and register your shares through your broker on the OPR system during the aforementioned MTO period to receive the MTO price per share (i.e. EGP7.50 per share).

But when will you consider accepting the MTO?

If MTO price is higher than the market price and its fair value.

- Reject the MTO by simply doing nothing. In other words, do not submit your shares in the MTO, hence you will continue to hold on to your shares.

But when will you reject the MTO?

If MTO price is lower than the market price and its fair value.

- If you are not a shareholder in RACC, you need to assess the situation to make an investment decision, as follows:

- Consider the MTO price versus the market price. If the MTO price is higher than (i.e. at a premium to) the market price (not the case today), then there might be a good chance to make a profit within a month by buying RACC in the market at a price that is lower than the MTO price. However, you need to consider:

- The time value of money (since your sale proceeds will only show up on your account at the start of November).

- The opportunity cost of locking up some liquidity in RACC, thus forgoing other investment opportunities in the market that may generate a relatively higher return over the same time period.

- Consider the MTO price versus the stock’s fair value. If the MTO price is lower than (i.e. at a discount to) the stock’s fair value, then the MTO will likely confirm the acquirer’s (RAYA in this case) point of view that the stock is worth more than the MTO price. Thus, you might decide to jump on the bandwagon of RACC by investing at a price that you believe is below its fair value with the hope that the stock will move higher over time.

- Consider the MTO price versus the market price. If the MTO price is higher than (i.e. at a premium to) the market price (not the case today), then there might be a good chance to make a profit within a month by buying RACC in the market at a price that is lower than the MTO price. However, you need to consider:

What does this all mean for RACC?

- At EGP7.5 per share, the MTO values RACC at roughly EGP1.44 billion.

- RACC will remain listed on the EGX but potentially with a lower free float (at least 10%).

- RAYA reiterated that there is no immediate plan to take RACC private or to merge it with any other entity, so it will be business as usual, except for RAYA’s intention to:

- Expand RACC’s activities through partnerships with leading companies.

- Streamline RACC”s operations to capture synergies.

Valuation

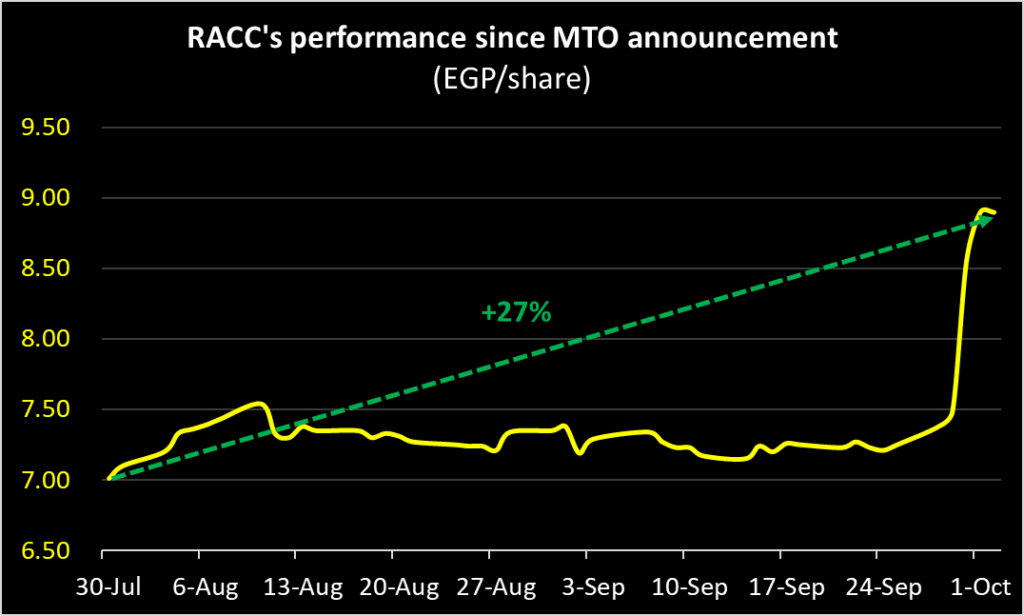

- On 30 July 2025, RACC was trading at EGP7.01 per share, 7% below the higher end of the MTO price range announced back then.

- From 31 July through 28 September 2025, RACC traded at a 3% discount to the higher end of the MTO price range.

- After the final MTO price (i.e. EGP7.50 per share) was announced, RACC rallied by as much as 31% versus the MTO price to an intraday high of EGP9.80 per share on 1 October.

- By the end of 2 October, RACC closed at EGP8.90 per share or 19% above the MTO price.

- To put things into perspective:

- At the time of RACC’s IPO back in 2017, the company was valued at EGP1.65 billion or equivalent to USD91 million at then-prevailing FX rates.

- Today, the MTO implies a valuation of EGP1.44 billion or just USD30 million at an FX rate of EGP48/USD, which is around a third of its IPO valuation.

- In terms of its earnings multiples, the MTO price values RACC at around 6x last 12-month (LTM) earnings), quite below both its historical and peers’ levels.

Recommended action

- We see the MTO as a meaningful development that could help RACC stock approach its fair value as per our estimates.

- Since the MTO was published, RACC’s stock price rose by more than 20% in four trading days, signaling a positive market reaction. This might suggest two things:

- Investors are betting that the MTO price could be raised over the coming few days, especially if the independent financial advisor’s (IFA) valuation came out to be higher than the MTO price.

- Investors believe RAYA’s move to consolidate its stake in RACC further aligns its interest with theirs, opening the door for more value creation down the road and affirming its confidence in RACC’s long-term prospects.